January 6, 2023

Guest Blog: Income Verification for Unsecured Personal Loans — Tactics and Best Practices

Auriemma Roundtables is excited to collaborate with industry experts to highlight topics of importance in the current economic environment. To contribute, contact Diana Middleton.

By Pritham Pattamatta, Business Lead for Personal Loans, SoFi

Today’s macro environment is dynamic and there is strong competition for good customers. Lenders must be able to make fast, well-informed decisions to serve their customers while managing risk and cost.

While underwriting and pricing decisions for unsecured personal loans have been completely automated, income and employment verification have not been fully automated.

Income and Employment verification are important to assess a customer’s ability to pay back a loan and their disposable income. To provide an offer of credit, the customer is asked several questions by the financial institution, one of them being income. The financial institution typically evaluates the customer’s creditworthiness using credit bureau data and their ability to pay using the income provided by the customer. If the customer mis-represented their income then the financial institution may make the wrong credit decision. It is hence vital to verify the stated income. Good customers seeking loans usually have multiple choices. Friction (asking customers to prove their income) could lead to loss of creditworthy customers.

It is essential for lenders to understand where to add friction and how that helps improve the quality of their portfolios. Continuous testing and leveraging a hybrid (automated + manual) verification strategies would be important.

Income verification approaches used today

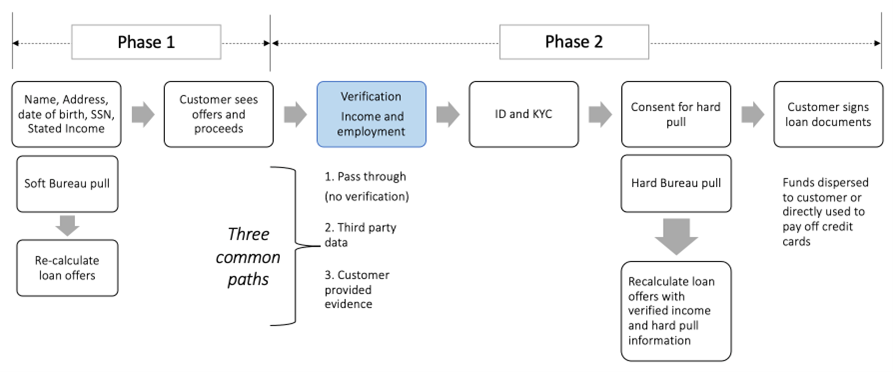

With the increased use of soft pulls, lenders typically use a two-step process to underwriting today. In phase 1, they provide a contingent offer of credit based on stated income and in phase 2, they confirm this offer based on a hard pull, income, employment, KYC and fraud checks.

Figure 1 : Typical loan application process

Phase 1 is completely automated and the decision is instantaneous. The customers that drop off in this phase of the funnel usually do not like their offer from the lender.

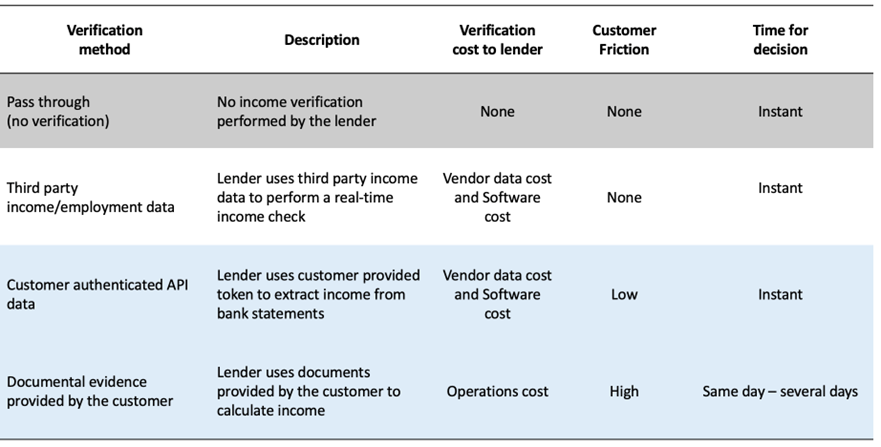

Phase 2 may not be automated for all applicants. There are four distinct methods that lenders use today. For a select group of customers the lenders deem it is not required to verify income so they ‘pass through’ income verification. For the remaining population lenders use a combination of third party data sources, customer permissioned API data and documents provided by the customer to verify income.

Table 1 : Verification methods

No verification is most relevant where the customer has established relationship with the lender. Lenders must however exercise caution while granting a bypass and should consider factors such as the loan amount, credit scores, stability of income and employment in addition to an established relationship.

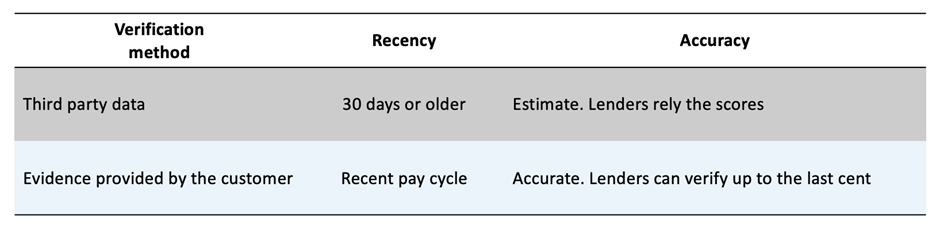

Third party data sources require no effort from the customer and allow the lender to assess reasonableness of the customer stated income. It is important for the lender to understand the scores and income estimates provided by the vendor and the bounds of reasonableness. Appropriate model and fair lending governance and monitoring should be setup.

Two main types of data sources exist:

- Employer reports directly to the bureau

- Income score predictors

Customer authenticated API data requires low effort from the customer. This method usually involves customers logging into their bank account while in the lender’s application. The lender must build an API connection to the vendor. The customer’s trust in the lender will be a crucial element in completion. In addition, the lender must be able to store, aggregate and calculate income from a large volume of transactions. Sometimes, vendors can provide aggregated income estimates. If lenders choose to use these estimates, they must validate the efficiency against current document verification processes. Appropriate model and fair lending governance and monitoring should be setup.

Two main types of data sources exist:

- Payroll aggregators

- Cash flow data

At first glance, evidence provided by the customer seems to be the least risky way to underwrite the customer, but it is not always the case. Since the customer needs to take additional steps – they may walk away from the loan application. This is especially true if the customer has multiple offers (as is normally the case for creditworthy borrowers). The customers who are willing to go through the process of uploading documents and waiting for several days for approval probably do not have offers from other lenders which could indicate that they are riskier.

The benefit of asking customers to provide documents is that the lender can decline customers that mis-represent income. Lenders will need to establish standard procedures and calculators for operators reviewing documents and extracting income. The lender also needs to review and update such procedures at regular intervals to remain relevant. It is also vital to setup quality control to monitor the adherence to policies and procedures and eliminate bias from an operator standpoint. In addition, the reasons for declining the customer should be user-friendly and consistent.

Table 2 : Key differences in verification methods

Permissible use of data

Third party data providers must protect customer data and ensure that control of the data remains firmly in the hands of the consumer. Adherence to the Fair Credit Reporting Act (FCRA) will be critical. FCRA promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. If a vendor is FCRA compliant, lenders may use them to make approve or deny credit to the customer. If not, it is a best practice to use the data for verification purposes only. In other words, if a customer does not qualify for credit based on third party income data, the lender must simply ask them to verify their income through other means such as providing documental evidence.

How to decide the right verification strategy

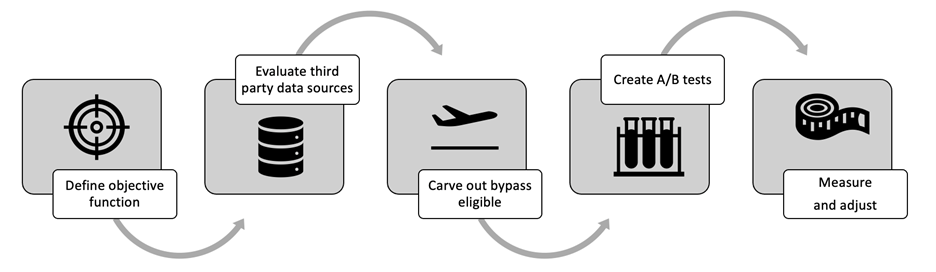

While setting up verification for the first time, most lenders start with verifying income for all customers coming through the door. However, to remain competitive it is advisable to introduce verification using third party data and pass through. There are 5 key steps to setting up a continuous optimization framework for verification.

Figure 2 : Iterative process for optimization

- Define the objective function: While it may seem obvious that maximizing profit is the objective function for the lender, there are several other constraints to consider. One such factor is life of loan loss rate. Others include tolerance level for income reasonableness, budget, and customer satisfaction scores.

- Evaluate third party data sources: It is recommended to perform an offline study with multiple vendors to create a shortlist of vendors that would be tested live in the production environment. In order to conduct such a study the lender would identify a prospect pool of customers (where the verified income already exists) and gather scores/income estimates for the same. The lender may want to assess accuracy of income prediction (verified income vs. income estimates and income confidence scores). In cases where the customer input is required (i.e. cash flow data) the lender may not be able to carry out such a test. The lender can in such cases use best practices offered by the vendor or create a set of rules like document verification practices that already exist. Lenders should also consider flexibility of data access, security measures adopted by the vendor, model governance practices, the relevance of the scoring algorithms to the lender’s target customer and any regulatory implications while selecting a vendor.

- Carve out bypass eligible: The bypass eligible population can be selected to optimize the objective function further by reducing vendor management and software costs. It is recommended to bypass customers where verification of income leads to no incremental risk reduction. Lenders should continuously look for such pockets within their credit box through continuous testing.

- Set up A/B tests : Lenders should test various flows (i.e. bypass before third party data (lower cost) and bypass after third party data and trying out different vendors in a parallel (get information from all vendors and develop an ensemble score) or waterfall approach (stop if you receive response) to understand the flow that is most optimal. Budget constraints, software development costs are important constraints.

- Measure and Adjust : Lenders should monitor key metrics such as conversion rates and early default rates for different paths. These KPIs should help feed the objective function to determine the best path. Once such a path is setup (champion), Lenders should introduce other tests (challenger) to ensure they are continuing to optimize. In addition, lenders should always use key macroeconomic indicators like unemployment rate and inflation to adjust income verification strategies.

Conclusion

Income verification is a critical component of credit underwriting. As technology and data evolves, the industry is moving towards automation and instant verification. While there is value in utilizing customer provided documents, lenders should look to obtain this information from trusted vendors. This eliminates customer friction and provides risk mitigation. While evaluating vendors it is important to cast a wide net and create a set of objective and subjective evaluation criteria. Continuous testing and optimization are required to remain relevant in a competitive marketplace and under changing macroeconomic conditions.