November 4, 2025

From Volume to Value: Trends in Wealth Management Customer Service

Wealth management contact centers are evolving alongside changes in consumer behavior and service technology. As self-service capabilities expand and digital channels handle a greater share of routine activity, call volumes are declining and the nature of client interaction is shifting.

The contact center remains a central part of the wealth client relationship model, but with an increasing focus on managing complex inquiries, improving authentication, and excelling in moments that require human expertise, according to data and insights from Auriemma Roundtables’ Wealth Management Customer Service Roundtable.

Lower Volume, Higher Stakes

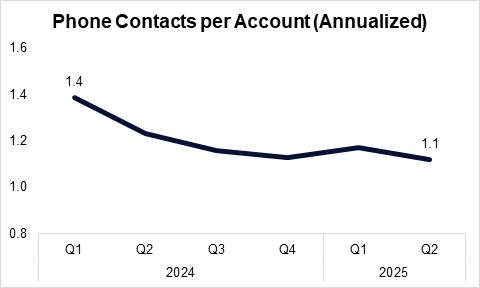

Across wealth management, contact centers are seeing fewer inbound calls as digital channels absorb more routine activity. Auriemma Roundtables benchmarking data shows that annualized phone contacts per account have declined by 21% between the beginning of 2024 and mid-2025, reflecting a greater emphasis on digital channels. Meanwhile, the conversations that remain tend to be more complex, higher value, and increasingly intertwined with issues of security and trust, according to members of Auriemma’s Wealth Management Customer Service Roundtable.

Source: Auriemma Roundtables Benchmarking Data

As call volumes ease, agent availability has improved, increasing 39% between Q1 of 2024 and Q2 of 2025. The increase reflects a more balanced operating environment, in which capacity is no longer consumed by low-level inquiries and where staffing levels can be aligned more thoughtfully with client demand. Agents are spending less time managing queues and more time preparing for meaningful interactions, reviewing client histories, and resolving issues that require judgment rather than scripted responses.

Source: Auriemma Roundtables Benchmarking Data

As phone volumes decline and agent availability rises, servicing leaders have an opportunity to refine the focus of their performance scorecards. In wealth management, average handle time has historically been less central than in other contact center models. With fewer routine calls in queue, speed matters even less. The emphasis is continuing to shift toward qualitative outcomes: the relevance of insight provided, the clarity of guidance, and the extent to which interactions reinforce trust and long-term client relationships.

Authentication as a Service Touchpoint

Authentication has become a defining element of the client journey in an environment shaped by regulatory updates such as the NYDFS cybersecurity rule and ongoing identity-theft threats. Institutions are re-engineering their controls to balance protection with ease of use.

Traditional PIN and password methods are being supplemented with two-factor authentication, passkeys, and voice biometrics – approaches that strengthen defenses while preserving accessibility. Only 20% of Roundtable member companies have deployed biometrics today, but the majority plan to do so within the next implementation cycle as systems and vendor integrations mature.

Source: Auriemma Roundtables In-Meeting Survey

This generation of security tools relies on a combination of behavioral analysis, device fingerprinting, and real-time verification.

Agent training mirrors this evolution. Many organizations now include modules on synthetic-voice detection, red-flag recognition, and situational awareness. These lessons help agents discern subtle cues that differentiate legitimate clients from emerging fraud patterns. In this way, authentication has moved from a background process to a visible, confidence-building moment in every interaction.

The Expanding Role of AI

Artificial intelligence has added another dimension to contact center transformation. What began as a set of isolated tools – speech analytics, auto-summarization, chatbot interfaces – has grown into a broader framework for understanding and improving client engagement.

Institutions are using AI to transcribe and summarize calls, highlight sentiment shifts, and detect recurring friction points. These capabilities help leaders identify process pain points and training opportunities without manually reviewing thousands of interactions. AI also supports conversational bots within IVRs, enabling faster resolution of single-task requests such as password resets or account balance inquiries.

The goal, however, is not full automation. AI is being implemented to simplify routine work and ensure agents arrive to each interaction prepared with context, history, and insight. It allows human expertise to focus where it adds the most value – on reassurance, decision support, and exception handling.

Some firms are piloting dual-channel models, where agents handle limited chat interactions alongside calls to provide continuity across platforms. Others are embedding knowledge-management AI tools that suggest responses or locate relevant documentation in real time. Across the board, the technology is being used to remove administrative friction, not human judgment.

Building and Retaining the Workforce

This reorientation toward higher-value work has influenced how wealth institutions recruit, train, and retain talent. Contact-center teams are smaller, more specialized, and increasingly equipped to handle both operational and advisory tasks.

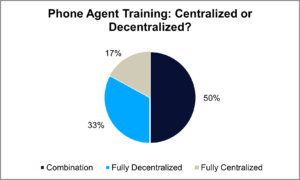

Most firms now rely on blended training models, combining enterprise-wide programs with contact-center subject-matter experts or selective outsourcing. The approach ensures consistency in compliance and client standards while allowing local adaptability in coaching and performance management.

Source: Auriemma Roundtables In-Meeting Survey

Workforce structures continue to vary by organization. Some institutions remain fully on-site to maintain close supervision over licensed staff and high-risk transactions. Typical team-lead ratios range from 12:1 to 20:1, with adjustments based on licensing and product scope.

Investment in professional development has become a defining feature of top-performing teams. Many firms now fund study time for Series 7 or related licensing exams, offering paid programs that can span several weeks. These initiatives strengthen technical capability and create a clearer career path for service employees.

Rethinking Quality and Measurement

As the contact center’s mission broadens, so does the definition of performance. Many firms are placing even more emphasis on after-call work, first-contact resolution, and client sentiment – metrics that align more closely with overall satisfaction and loyalty.

AI-based quality-assurance systems complement these efforts by analyzing tone, empathy, and compliance cues across large datasets. This data-driven approach enables managers to identify coaching opportunities quickly and to connect individual behaviors with enterprise-level outcomes.

The emphasis on measurement is not disappearing; it is being refined. Quality is now seen less as an inspection process and more as a learning system – one that helps organizations anticipate client needs and continuously adapt to them.

A New Model for Client Engagement

Together, these developments are redefining the contact center’s place within wealth management. It is no longer a reactive function that measures success in call counts and handle times. It has become an integrated component of the client relationship ecosystem – anchoring digital interactions, ensuring authentication integrity, and reinforcing the institution’s brand promise.

Clients who rarely speak to an agent still rely on the systems those teams help maintain. The same data that reduces call volume also informs personalization across digital channels. In this sense, the contact center’s reach now extends well beyond the call itself.

As wealth management continues to balance automation with human expertise, the contact center remains a focal point for that balance – a space where operational excellence, security, and empathy converge. The Wealth Management Customer Service Roundtable helps institutions measure progress, compare approaches, and prepare for the next phase of the client-service evolution. For more information, contact Barry Lynch.