October 29, 2025

The Evolution of Deposit Risk: From Back-Office Concern to Strategic Priority

Deposit risk has evolved from a back-office concern to a strategic priority. Issues once viewed as routine cleanup—managing overdrafts, returns, and exception items—are now central to financial institutions’ risk posture.

Rising liquidity pressures and increasingly sophisticated account abuse have blurred the lines between deposit risk, credit risk, and fraud prevention. As overdraft lines evolve, as provisional credit becomes a recurring vector for abuse, and as external account linking stretches the boundary of what “verification” really means, institutions need to integrate fraud, compliance, and credit views more tightly than ever.

In this analysis, we use data and insights from Auriemma Roundtables’ Deposit Risk Roundtable to illuminate how the function is quickly maturing in an evolving environment, one defined less by transactional volume and more by behavioral intent.

Overdraft Usage: Volume Without Velocity

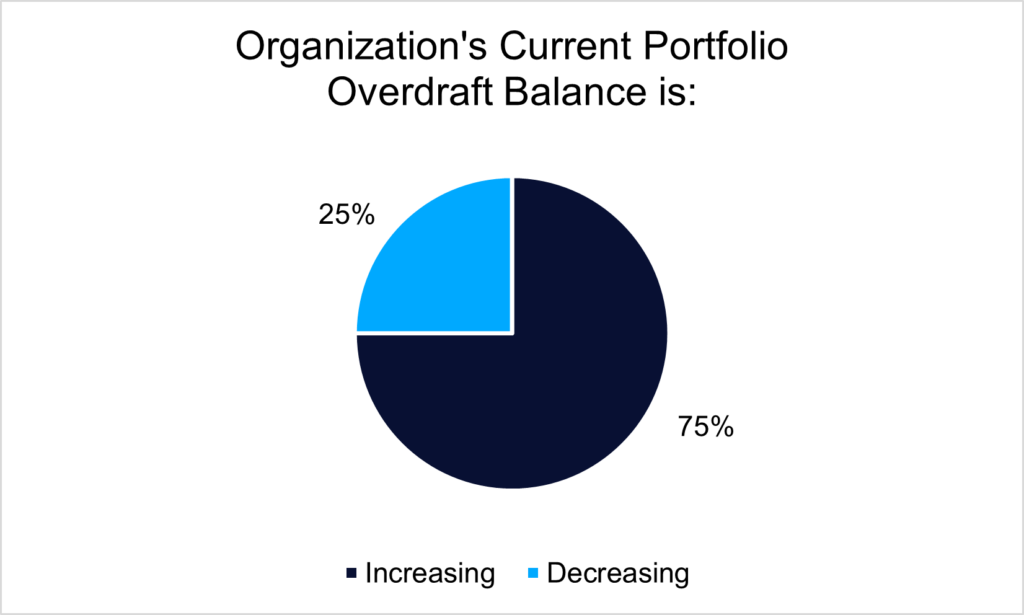

As of August 2025, overdraft activity is on the rise, with three in four institutions reporting higher overdraft balances, according to Auriemma Roundtables data. The pattern reflects liquidity stress among those most exposed to inflation and irregular expenses as they lean on overdraft coverage to bridge income gaps.

Source: Auriemma Roundtables Data

Some institutions attribute the growth to a financially strained customer base, while others see signs of first party fraud, particularly around provisional credit claims and digital-funding channels. Pre-funding account underwriting and abuse controls have helped stabilize losses even as overdraft usage climbs.

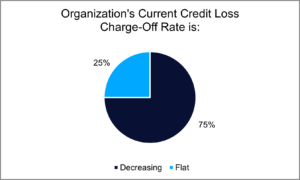

Even as overdraft balances increase, Auriemma Roundtables data indicates credit loss charge-off rates – the percentage of dollars written off as uncollectible – are actually on the decline, largely due to stricter internal controls and claim-review processes. Yet beneath that stability lies growing exposure. Rising OD balances are often the first sign of liquidity strain, and the timing of losses tends to lag behind behavior shifts. In an environment of persistent inflation and uneven wage growth, the apparent calm may be temporary.

Source: Auriemma Roundtables Data

“What we’re really witnessing is the deposit portfolio taking on more credit-like characteristics, where access and liquidity management begin to mimic unsecured lending,” explained Auriemma Roundtables Director Troy Huth.

First-Party Fraud: The Hidden Epidemic

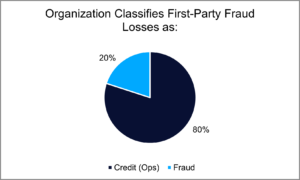

If overdraft activity reflects the surface of deposit risk, first-party fraud represents a deeper, less-visible layer. According to Auriemma Roundtables data, 80 percent of institutions said first-party fraud losses are classified as credit losses rather than fraud. That misclassification can mask both scale and source.

Source: Auriemma Roundtables Data

Unlike traditional third-party fraud, which involves stolen identities or external actors, first-party fraud originates with the legitimate customer. Applicants open accounts in their own name, pass identity verification, and then manipulate the product – disputing authorized transactions, misusing provisional credit, or exploiting refund windows. In deposit products, the abuse often centers on overdraft and ACH channels: customers artificially inflate balances, pull funds from external accounts that never clear, or claim unauthorized transactions that may in fact be legitimate.

This gray area between fraud and credit loss has grown rapidly. Industry research from LexisNexis estimates that first-party fraud now accounts for more than a third of all fraud losses, costing financial institutions tens of billions annually. And because these behaviors often appear rational – linked to financial distress, not deceit – they’re harder to detect with traditional fraud models.

The effects are becoming evident. Auriemma’s member institutions report rising provisional credit abuse and increasingly complex dispute patterns that demand stronger triage and case-prioritization strategies. ACH funding schemes are also growing more coordinated, with repeat activity concentrated through specific external institutions and channels. Meanwhile, R10 ACH return codes, which indicate nonauthorized transactions, are all on the rise. Taken together, these behaviors illustrate how deposit risk is shifting – credit exposure and fraud are bleeding into one another, creating a more sophisticated threat landscape that is harder to classify, track, and mitigate.

Verification Stress: The Weakest Link

As institutions expand digital onboarding, they rely on external account linking to confirm account ownership. But when those links fail – especially with non-EWS participants – banks are left with few good options. Some institutions utilize micro-deposits, which confirm access but not ownership. Other FIs stop the funding process altogether, effectively declining new relationships they can’t verify.

At the same time, funds-availability strategies are tightening. Several institutions now apply differentiated hold rates based on channel risk, with remote deposit capture (RDC) flagged as especially vulnerable. The overall stance is one of preparation: compliance may still be uncertain, but proactive monitoring is already becoming the norm.

The Convergence of Risks

Auriemma’s Deposit Risk Roundtable members are mulling the impact of these underlying trends: Overdraft balances are increasing, but losses are momentarily stable. Charge-offs are down, but risk exposure is shifting into fraud. Verification failures and ACH return codes (notably R10) are rising, hinting at both process abuse and external-institution gaps.

Auriemma Roundtables’ benchmarking data reinforces this point. Growth in overdraft usage and flat charge-offs should be seen not as contradictions, but as a window into how well their controls are functioning under stress. In pragmatic terms, deposit portfolios are healthy but not invulnerable. Losses are controlled because teams have grown smarter – deploying better models, refining claim rules, and automating low-risk cases – but the underlying customer behaviors are shifting fast.

A New Framework for Deposit Risk

In Auriemma Roundtables’ Deposit Risk Roundtable, deposit product teams work together to spot what no single institution can see alone. By comparing practices, surfacing pain points, and pressure-testing emerging threats, the group uncovers how tighter controls and rising complexity are unfolding across the industry. The collective view shows that even when losses appear contained, the underlying exposure is shifting in ways that demand new thinking.

The Deposit Risk Roundtable continues to be a forum where financial institutions can compare experiences in real time, pressure-test emerging controls, and stay ahead of evolving threats across overdraft, ACH, and provisional credit channels. As these trends accelerate, the ability to learn from peers becomes even more critical.

To participate in upcoming discussions or explore insights from this Roundtable in more detail, contact Zeenat Shah.