September 30, 2025

The Future of Commercial Banking: Intelligence, Trust, and Transformation

Commercial banking is bracing for a decade of disruption. Stricter regulations are reshaping compliance standards, clients are demanding faster and more seamless experiences, and non-bank rivals like private credit funds and fintech lenders are moving aggressively into territory once dominated by traditional institutions.

For commercial institutions, growth, client loyalty, and institutional stability are at stake: Competitors are springing up across the ecosystem, with private credit funds and independent finance companies capturing middle market share. Meanwhile, commercial banking has lagged behind consumer-banking counterparts in digital innovation. And fraud schemes are increasingly sophisticated, from business email compromise and account takeovers to insider collusion and trade finance abuse.

The institutions that succeed will be those that adapt their business models to compete in a reshaped ecosystem by investing in embedded APIs, cloud-native infrastructure, and real-time analytics to deliver superior customer service while containing fraud risk.

Regulation, Competition, and the Rise of Non-Bank Lenders

In the years since the 2008 financial crisis, stringent capital and risk requirements have steadily pushed commercial lending out of the banking sector and into the hands of non-bank lenders. Private credit funds and independent finance companies have surged past banks in middle-market finance, with U.S. private credit reaching $1.7 trillion by early 2024. Non-banks financed 85% of leveraged buyouts last year, up from 64% just five years earlier, and their market share in middle-market lending is expected to reach 40% by year-end 2025.

The competitors’ edge lies in flexibility: Covenant-lite loans, floating-rate structures, and bespoke terms allow sponsors and borrowers to structure deals banks cannot match under regulatory constraints.

The ecosystem is shifting accordingly, with private equity firms building in-house credit capabilities, investment banks pivoting to advisory roles, law firms adapting to covenant-lite drafting, and turnaround advisors shifting from crisis response to proactive monitoring.

But risks loom. Heavy leverage, concentration in sectors like healthcare and construction, and the dominance of covenant-lite structures could magnify instability if growth falters. For banks, this raises the question of where to defend market share directly, and where partnership with non-bank lenders is the smarter play.

From Digital Efficiency to Intelligent Banking

The first wave of digitization, dating back nearly two decades, provided commercial clients with faster and more convenient ways to interact with their banks. But as services became standardized, much of the personal touch and bespoke value that once made commercial banking relationships “sticky” began to erode. Many commercial finance clients now report feeling reduced to account numbers and interfacing with rigid platforms instead of trusted advisors.

Commercial banks are working to reverse this sentiment. Research shows that commercial banks are beginning to turn the vision of proactive, context-aware insights into reality. In one case, a regional bank used machine learning and external data to refine customer segmentation, giving relationship managers sharper, more tailored insights. The result was a 46% increase in loan applications, a clear signal that embedding smarter, data-driven tools into client engagement can reduce friction and deliver measurable growth.

“The future of commercial banking will still be reliant on banker-to-client connection—it isn’t about bots replacing bankers,” said Troy Huth, Director of Auriemma Roundtables’ Commercial Fraud Roundtable. “Technology should amplify the empathy and judgment clients value most.”

For mid-sized businesses that often feel overlooked by standardized lending or treasury products, the real differentiator is a banker who understands their business. Thoughtful segmentation can still inform strategy, but the real value comes when relationship managers translate those insights into customized credit structures, liquidity solutions, and risk management approaches. By 2030, banks are expected to act not just as capital providers, but as strategic partners delivering both financing and intelligence to help clients grow.

Relationship managers’ roles will also evolve. Increasingly, they will be deployed strategically and focused on complex clients, high-value relationships. For example, instead of routine account servicing, relationship managers will be increasingly deployed to guide corporate clients through complex liquidity structures, cross-border transactions, and risk exposures in which judgment and trust matter most.

Finally, customer-centricity must evolve from aspiration to execution. Seamless, personalized experiences will only be possible when banks operate as connected enterprises, aligning front, middle, and back offices around shared data and integrated processes.

Technology, Risk, and the New Ecosystem

The technological ecosystem around commercial banking has expanded dramatically in recent years: APIs, distributed ledgers, and AI-powered platforms are now integral to how banks operate. Many institutions are re-engineering lending, payments, and compliance processes to eliminate inefficiencies and improve client experience.

Yet technology delivers its full value only when the front, middle, and back office are aligned. Relationship managers need real-time visibility into credit decisions and liquidity positions; risk teams must be equipped with the same data streams that operations teams use to process transactions; and compliance must be embedded seamlessly into every workflow. Without that integration, efficiency gains remain siloed and clients experience friction. When connected through shared platforms and governance frameworks, however, these layers can move in unison—turning technology into not just a tool for efficiency, but a foundation for resilience, personalization, and trust.

Commercial Bank Fraud: An Evolving Threat Landscape

Fraud in commercial banking has become more complex and more costly as criminals adapt to the scale and speed of corporate transactions. Unlike consumer schemes that target individuals, commercial fraud exploits the structures of businesses, their financial operations, and the trust embedded in high-value relationships. Meanwhile, deepfakes and synthetic identities are already complicating fraud detection, while data sharing with fintech and big-tech partners introduces new vulnerabilities. For commercial banks, the stakes are high: losses can escalate into the millions within hours, reputational damage can strain client relationships, and systemic risks can ripple across entire ecosystems.

Business Email Compromise and Payment Redirection

Business email compromise (BEC) is the leading threat for commercial clients. Fraudsters infiltrate or spoof corporate email systems to redirect vendor or supplier payments. The scale of commercial transactions makes these attacks devastating: what appears to be routine treasury activity can mask multimillion-dollar losses.

“In corporate payments, fraudsters don’t need volume,” Huth said. “They just need one well-timed strike.”

Insider Abuse and Collusion

Insider collusion remains one of the most dangerous fraud risks in commercial banking. Employees or contractors with privileged access can override controls, manipulate approvals, or facilitate illicit transfers in partnership with external actors. These schemes often evade early detection because they exploit legitimate processes, such as loan underwriting or trade finance documentation. In some cases, insiders have been linked to laundering networks that use commercial channels to layer illicit funds. Detecting such activity requires strong segregation of duties, real-time monitoring, and robust whistleblower programs. Insider threat risks accelerated with the advent of remote work and as contractor reliance expanded access to sensitive systems.

Account Takeover and Treasury Service Abuse

Corporate treasury portals and cash-management platforms are frequent targets of account takeover. Once fraudsters gain access, they can initiate bulk payments, alter standing instructions, or sweep liquidity pools across subsidiaries and currencies. Continuous monitoring and behavioral analytics are now essential to spotting anomalies in treasury flows.

Combating Fraud with AI

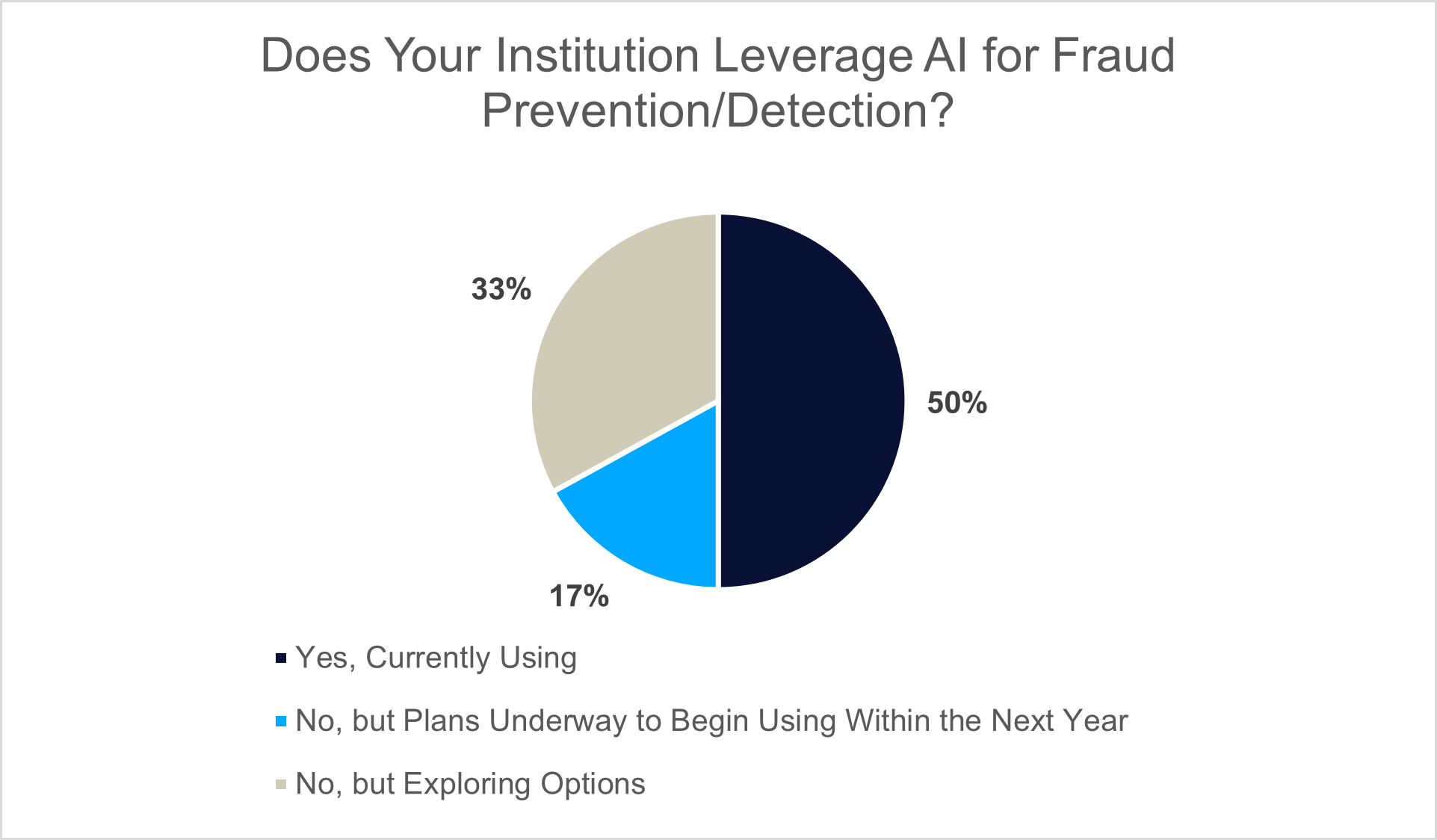

Most banks now view artificial intelligence as central to the fight against commercial fraud. Auriemma Roundtables’ industry surveys show the majority (50%) of commercial institutions already deploy or plan to deploy AI-driven tools to detect anomalies in payments, flag suspicious behaviors, and authenticate client interactions in real time.

Machine learning models can sift through massive transaction flows faster than human analysts, identifying subtle patterns—such as deviations in vendor instructions or timing of treasury transfers—that may indicate fraud. Banks are also experimenting with AI to counter emerging threats like deepfakes by analyzing biometric markers or voice inconsistencies. While these systems are not foolproof and require strong governance, they are quickly becoming indispensable for reducing response times and limiting the scale of losses.

About Auriemma Roundtables’ Offerings for Commercial Banks

Auriemma Roundtables supports commercial banks by providing platforms for intra-industry collaboration, candid dialogue, and rigorous benchmarking.

Auriemma Roundtables currently offers:

For information on membership, contact Zeenat Shah.