November 5, 2024

Subprime Borrowers More Likely to Abandon Auto Loans: How Lower Interest Rates Result in Increased Repossessions

Declining interest rates have prompted unexpected trends in the subprime market.

By Sheldon Stewart, Director, Auriemma Roundtables

For the last two months, Auto Collections Roundtable members have reported a growing number of borrowers intentionally halting payments on their loans, resulting in increased vehicle repossessions. This trend is most prevalent among high-risk, low-credit-score borrowers making a strategic, if paradoxical, decision: Despite long-term consequences, the prospect of lower rates “encourage” these borrowers to walk away from their existing loans to take advantage of new, more favorable loan terms on other cars. This phenomenon sheds light on how interest rate changes can unintentionally fuel auto loan defaults and repossessions for subprime borrowers.

The Current Used Auto Loan Environment

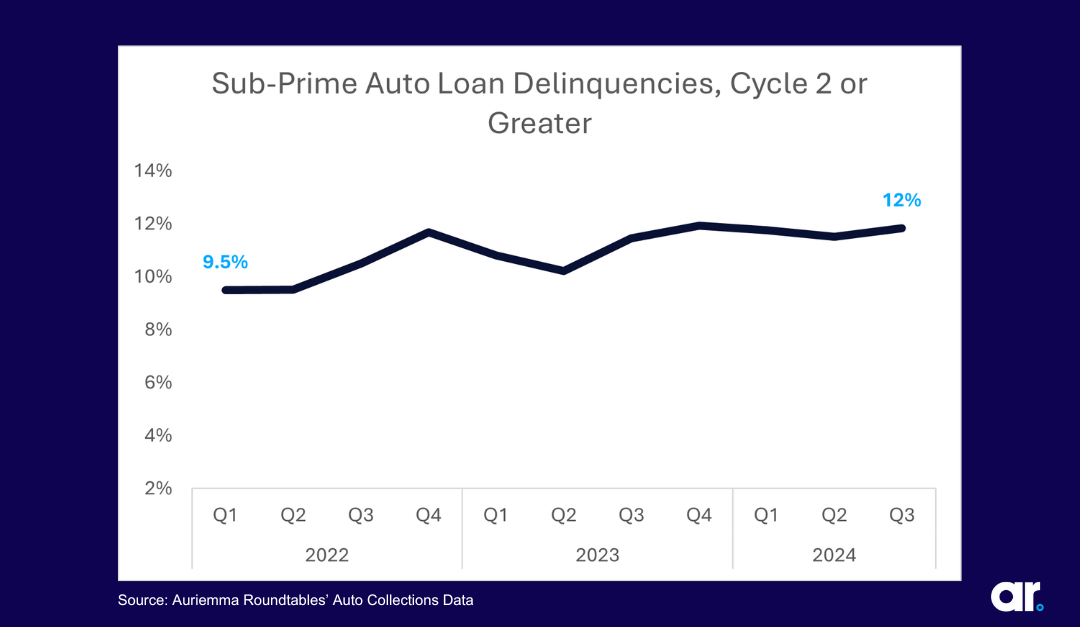

Beginning early 2023, the auto loan market operated in an environment of relatively high interest rates, especially for subprime borrowers, who operate largely in the used car space. Interest rate pressures have driven up auto loan delinquency, with 12% of subprime borrowers being two or more billing cycles in arrears in the third quarter of 2024, compared to 9.5% in the beginning of 2022. More recently, the Fed has introduced looser monetary policy, and is generally expected to cut interest rates again by the end of the year.

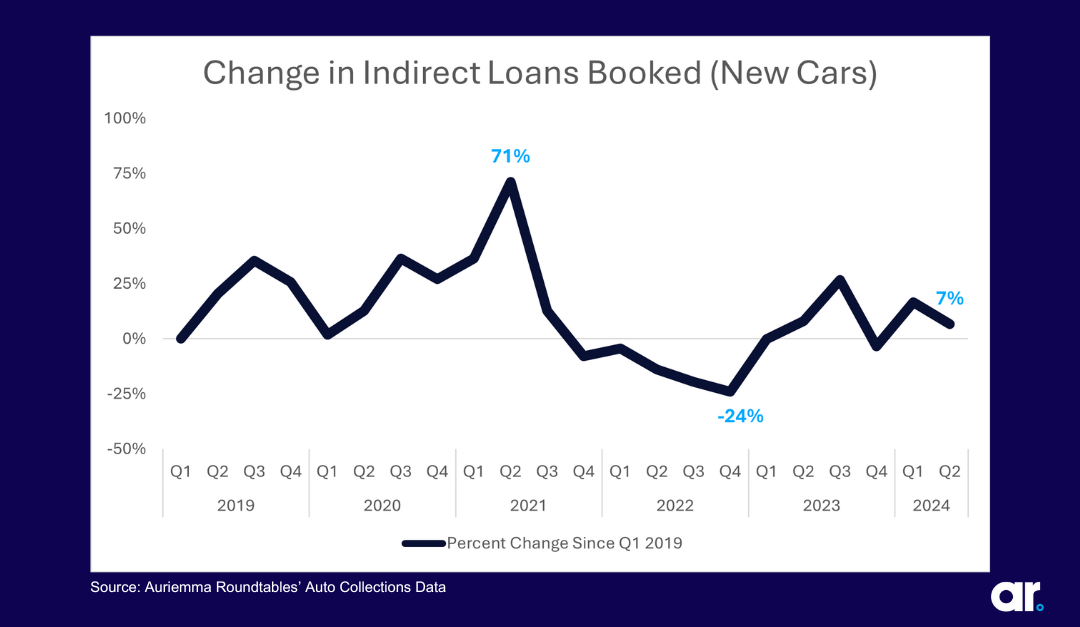

Meanwhile, new car sales have recently rebounded from a pandemic era slump. Because new car sales represent the predominant driver of used car supply, this results in more used cars entering the market, lowering the value of existing used cars.)

The collision of subsiding interest rates with the upstream influx of vehicles into the used car market has shocked loan-to-value ratios, which have shot upwards across credit tiers in response. Many subprime borrowers have loan balances greater than the market value of their vehicles, resulting in the ill-advised incentive to abandon auto loans.

How Lower Interest Rates Prompt Loan Abandonment

For subprime borrowers, a return to lower interest rates signals an opportunity to access new loans that are more affordable than the original loans they secured. This group of borrowers, often teetering on the edge of delinquency, might see abandoning their current vehicle loan—thereby triggering repossession—as a means of resetting their financial situation. Before or during the repossession process, these consumers pursue financing for a separate vehicle. While the consequences of a repossession on one’s credit score are severe, for many high-risk borrowers already facing poor credit, this negative impact may not seem any worse than their existing situation.

This growth in auto loan abandonment highlights how lower rates can drive unintended consequences in the subprime lending market. The prospect of obtaining a better deal in the future can outweigh the downsides of vehicle repossession.

‘Involuntary’ Repossessions on the Rise

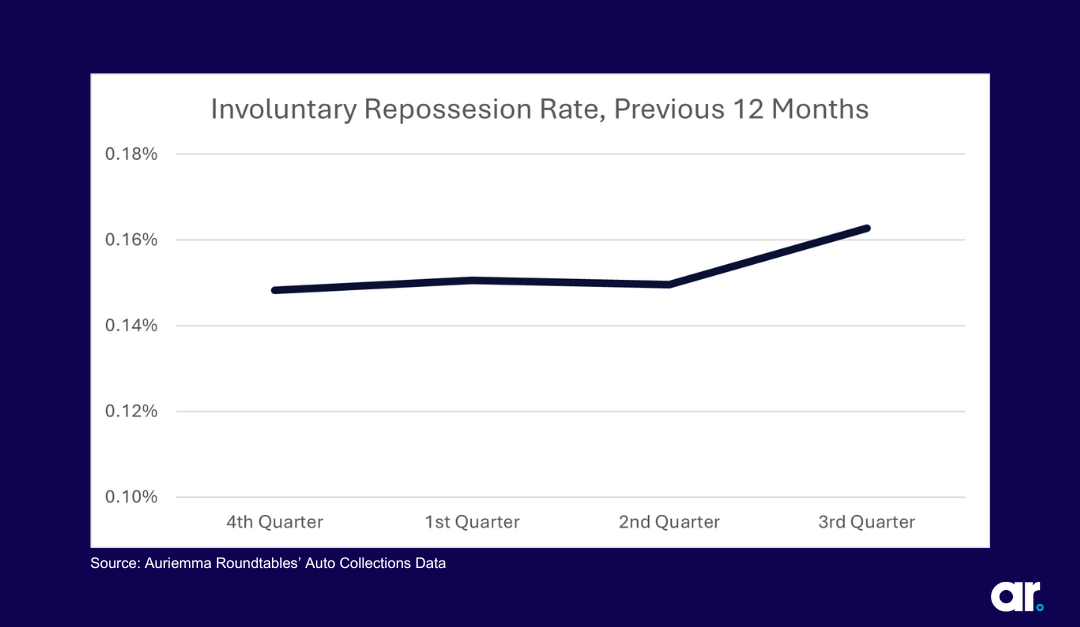

It should be noted that although abandonment is itself voluntary on the borrower’s part, lenders code these losses as involuntary because it triggers the repossession process, as opposed to when borrowers surrender their vehicle directly to the dealer or lender.

The outcomes of this shift are evident in Auriemma Roundtables’ auto loan collections data, where the frequency of involuntary repossessions—in which the borrower defaults and the vehicle is repossessed by the lender—has seen a marked increase. Data points show that, particularly in the subprime market, delinquency rates are climbing as borrowers walk away from their loans. (Voluntary repossessions have remained low.)

Implications for Auto Lenders

The aforementioned trends pose significant challenges for the auto lending industry, particularly for lenders heavily invested in the subprime market. As more borrowers opt for repossession over continued payments, lenders must reconsider the risks associated with financing high-risk borrowers. The increase in defaults and repossessions could lead to tighter lending standards, making it more difficult for low-credit individuals to access financing in the future.

Moreover, originators may have to rethink the structure of subprime loans in a lower interest rate environment. Adjustable-rate loans, new repayment terms, and risk-based pricing models could become more prevalent as lenders seek to mitigate the risks of increased defaults and repossessions. For the industry, navigating the balance between offering accessible loans to subprime borrowers and managing the financial risks associated with default will be critical.

Staying Ahead of Borrower Trends

The rise in auto loan defaults and involuntary repossessions among high-risk borrowers is a striking example of how shifts in interest rates can reshape borrower behavior. For subprime borrowers facing the burden of high-interest loans, the allure of abandoning their vehicle loans to take advantage of lower interest rates offers an opportunity to improve their financial situation, even at the cost of repossession. However, this trend also signals significant challenges for lenders, who must grapple with the increased risks associated with lending in a volatile market.

Roundtables can help lending leaders stay on top of repossessions and other risks. To learn more, contact Sheldon Stewart or Tami Corsi to learn more about our Auto Collections Roundtable.