September 12, 2024

The Public Policy and Economic Trends Shaping Auto Loan Originations

A confluence of factors, from monetary policy to tax credits, is changing the landscape of auto loan originations.

For the last two years, high interest rates have cooled demand for vehicles, but, with the Federal Reserve expected to cut rates next week, more buyers could be drawn back into the market. The easing of COVID-era supply chain disruptions, along with increasing consumer confidence and the expansion of electric vehicle (EV) tax credits, will also have a positive influence on auto loan originations.

Considering these broader trends, lenders face unprecedented market conditions that require more than just reverting to pre-COVID business models. Lenders must balance potential growth opportunities with the challenges of evolving loan terms, as well as the risks associated with new financing trends.

Interest Rate Impacts

As consumers’ monthly payments on auto loans increased due to higher interest rates, many potential buyers either delayed their vehicle purchases or opted for cheaper alternatives, leading to a slowdown in demand.

With the Fed expected to cut interest rates next week, the forthcoming lower borrowing costs will likely result in an uptick in loan demand. For lenders, it translates to an increase in sales volume, although they must balance this with lower returns on the loans due to the reduced interest rates.

Return to Pre-Pandemic Supply Chains

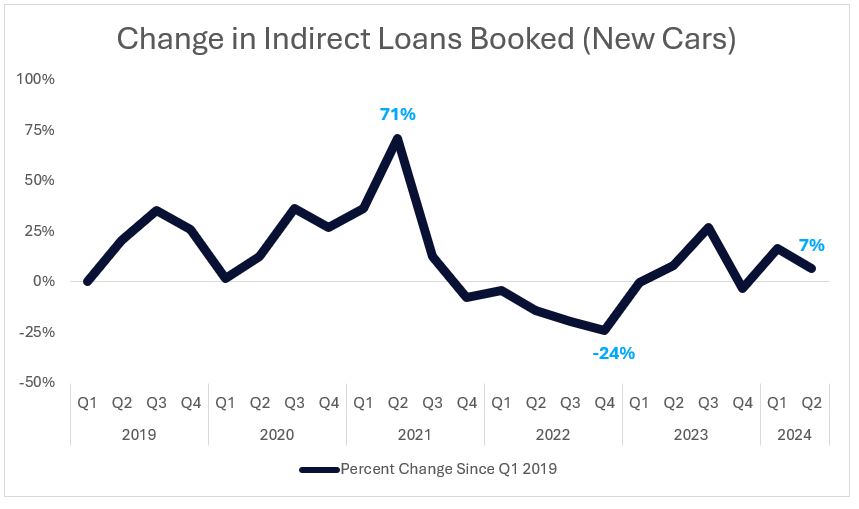

According to Auriemma Roundtables’ Auto Originations benchmark study, booked new car loans peaked in the second quarter of 2021, increasing 70% compared to Q1 2019. Supply chain bottlenecks, including a chip shortage, caused that figure to collapse over the next 18 months.

Despite these challenges, the market has shown signs of resilience. In the second quarter of this year, the volume of booked loans for new cars was up 7% compared to the levels seen in the first quarter of 2019. This increase suggests that the auto loan market is gradually recovering as supply chain issues begin to ease, and production slowly ramps up to meet consumer demand. While the recovery has been steady, it indicates a return to more stable market conditions after a period of significant disruption.

Consumer Sentiment Index

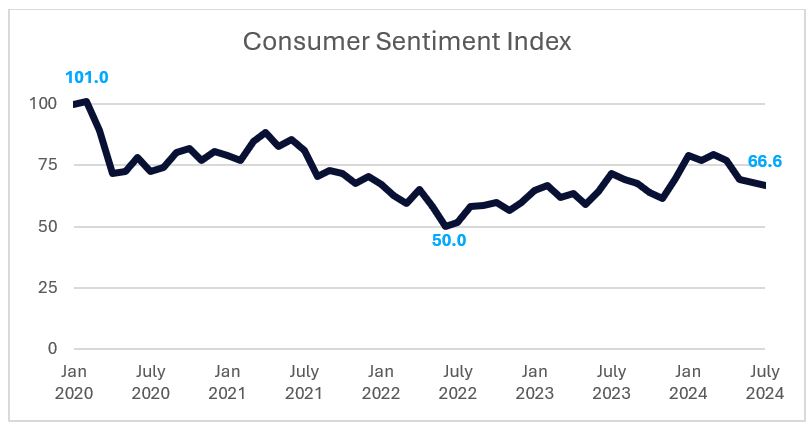

When the Consumer Sentiment Index (CSI) is high, consumers are more likely to feel secure in their financial situation, which boosts their willingness to take on new debt, including auto loans. This heightened consumer confidence drives demand for vehicles, leading to an increase in auto loan originations.

While the CSI has yet to recover from its pre-pandemic peak, it has broadly trended upward over the past two years, and lower interest rates could further this growth. Lenders, recognizing the favorable economic environment, may be more willing to extend credit, further fueling the growth in auto loans. In essence, high consumer confidence acts as a catalyst that drives the automotive market, encouraging more people to take on auto loans and thereby contributing to the overall expansion of the auto financing industry.

EV Tax Credits

Last year’s tax credit program contributed to an explosion in EV sales, totaling 4.8 million sold in 2023 – a 60% increase from 2022. EV tax credits have created ripple effects across the auto loan origination space, including:

- Loan Amounts and Terms: Borrowers are often financing not just the base cost of the vehicle, but also additional expenses such as extended warranties, home charging equipment, and sometimes even the installation costs associated with these chargers. This trend has led to an increase in the average loan amount for new vehicles, as well as potentially longer loan terms as consumers seek to manage monthly payments.

- Impact on Loan Delinquency Rates: Auto loan delinquency rates have been on the rise in recent quarters. The continuing rise of EV tax credits may mitigate some of these risks by effectively reducing the effective purchase price and providing consumers with a financial buffer.

- Influence on Loan Origination Strategies: Auto lenders have been compelled to develop specialized products and marketing strategies to cater to the growing EV market. This includes offering competitive interest rates, longer loan terms, and “green loan” products that are specifically designed for environmentally conscious consumers. These strategies have been essential in capturing the growing market segment of EV buyers.

The Power of Collaboration

As auto lenders adapt to these trends, staying ahead of industry developments is crucial for successful portfolio growth and risk mitigation. At Auriemma Roundtables, our auto lender members are at the forefront of these discussions, sharing insights, benchmarking, and developing best practices to navigate the challenges and opportunities in auto financing.

To learn more about joining the Auto Originations Roundtable, or contact Glenn Kranis or Tami Corsi.