June 25, 2024

The Top Credit Card Trends and Challenges of Summer 2024

What should credit card issuers look out for in the coming months? Auriemma Roundtables’ 13 different credit card-focused groups are dissecting several key developments: Higher delinquency rates, regulatory shifts, and the evolving fraud environment. Below, we outline how these trends will be intersecting, and what card issuers will be watching this summer to prepare.

Late-stage delinquency rates are up – way up

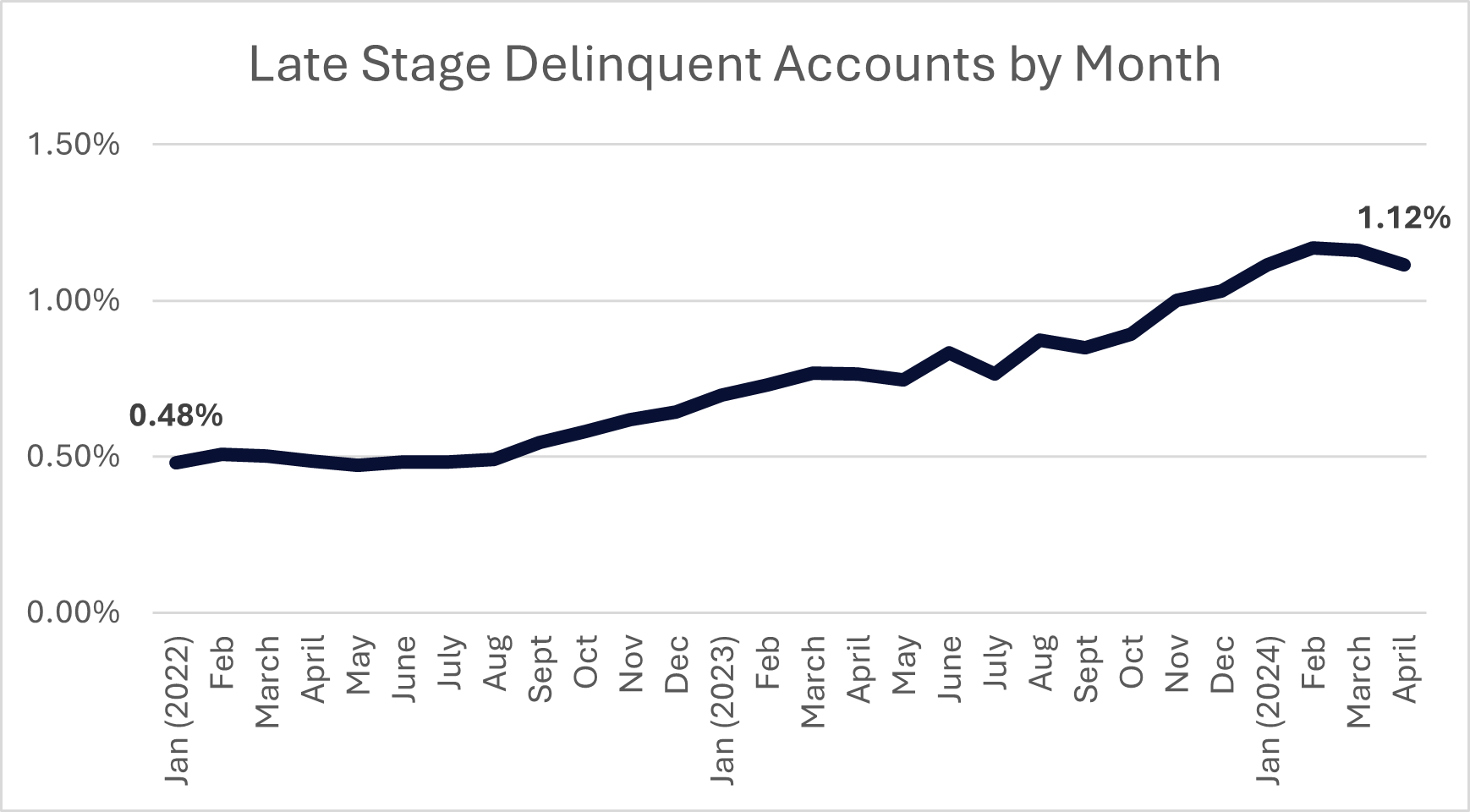

Benchmark reporting from our Credit Risk Management Roundtable, which captured data from 14 major credit card issuers, shows a pronounced increase in late-stage credit card delinquency (typically accounts that are five- or six-months past due, depending on the lender). Members reported a 130% surge in such delinquency, increasing to 1.12% of accounts in April 2024, up from 1.08% in January of 2022. This increase can reasonably predict higher credit losses in the future, as accounts in late-stage delinquency are likely to result in charge-offs.

What to watch for: How the Fed progresses in managing inflation could influence borrowers’ ability to repay credit card debt. Interest rates have held steady at a two-decade high since July 2023, but the industry will be watching for signals of the Fed’s “penciled in” 2024 interest decrease.

CFPB continues to push on late fees

As part of its mandate to tackle so-called “junk fees,” the CFPB has focused on credit card late fees. The proposed regulation would limit such fees to $8 for most violations, significantly reducing ways issuers can offset risks and costs associated with late or non-payment. The rule faces ongoing legal challenges and is currently stayed pending litigation in a Texas court.

Should the CFPB rule take effect, particularly in a time of higher delinquency, issuers will have to look elsewhere to make up the revenue gap, such as higher interest rates.

Unsurprisingly, lower-FICO borrowers are significantly more likely to pay late fees: According to a 2022 Boston Federal Reserve report, one quarter of sub-600 credit score borrowers pay a card late fee in a given year. Restricting avenues to recoup losses from these higher-risk consumers may prompt issuers to limit their exposure in other ways, such as offering lower credit limits or stepping back from lending in lower credit tiers.

What to watch for: All eyes are on the courts. Meanwhile, card issuers are evaluating potential portfolio impacts. Borrowers may notice increased interest rates or stricter lending criteria.

Rewards programs may be next focus for CFPB

The CFPB recently released a report detailing common complaints around credit card rewards programs, including: vague or hidden conditions, devaluation of rewards, redemption issues, and revocation of rewards.

In the report, CFPB Director Rohit Chopra hinted at potential future regulatory scrutiny, saying the Bureau “will be looking for ways to protect people’s points, stop bait-and-switch scams, and promote a fair and competitive market for credit card rewards.”

What to watch for: Reward programs may be the next front of CFPB regulators. Because reward programs are key to attracting highly qualified borrowers, regulatory scrutiny may put pressure on revenue that can offset higher delinquency rates and restrictions on late fees.

Tactics around dispute abuse are working

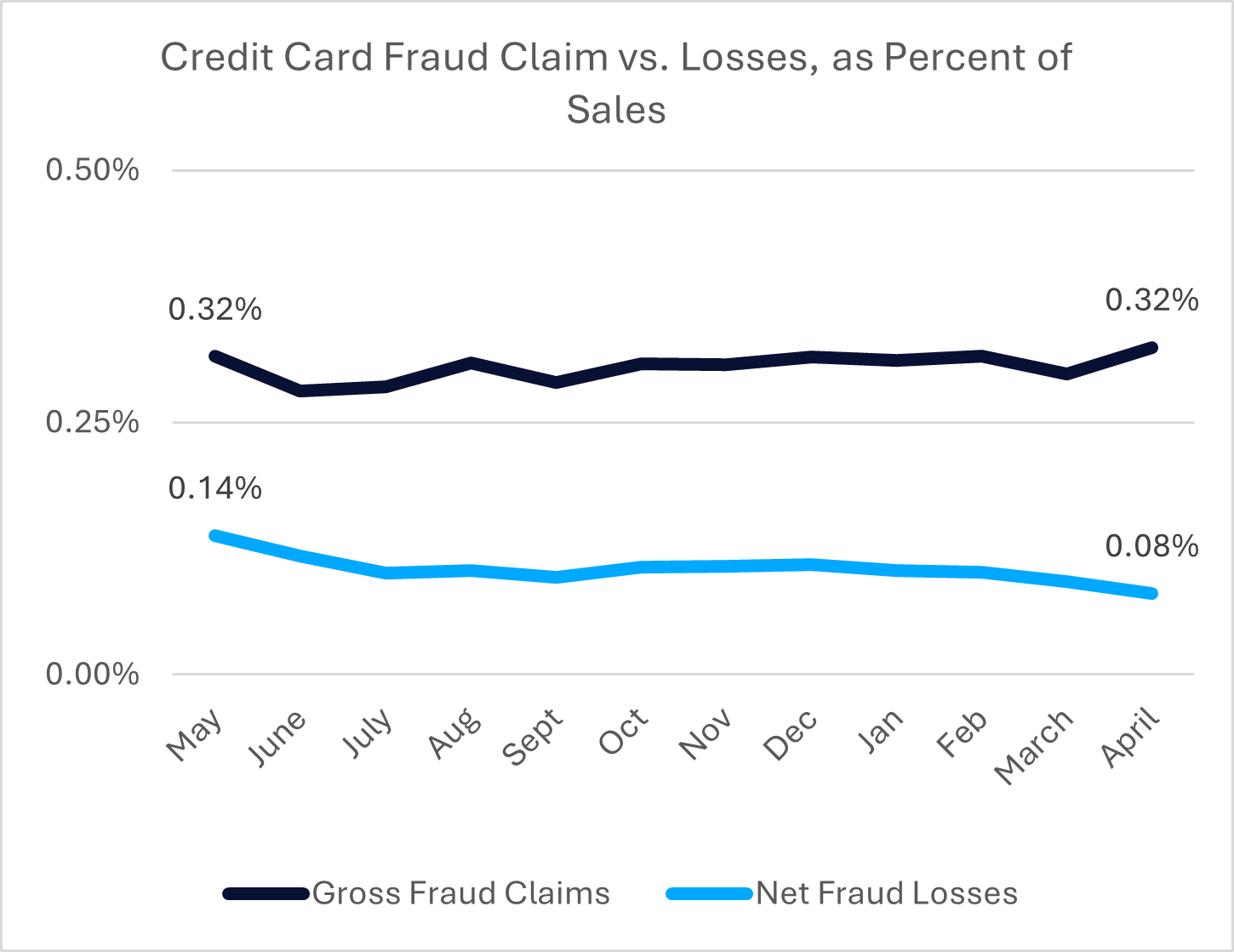

Card Chargeback Roundtable members reported the dollar value of fraudulent dispute losses declined by nearly 40% year-over-year period ending in April, down to 0.08% of sales volume from 0.14%. This came even as the percentage of transactions resulting in a claim remained steady.

The decoupling indicates more stringent efforts to crack down on dispute abuse – a component of credit card fraud – are starting to pay dividends.

What’s next: Fraudsters are adept at breaking new ground in how and where they perpetrate fraud. Issuers can stay on top of dispute abuse our special session on the topic in August.