November 11, 2025

Auto Borrowers Are Falling Behind: How Auto Collections is Reacting

As consumers face tighter budgets and higher living costs, auto loan delinquency is no longer defined by who falls behind, but by how long they stay there.

Consequently, auto lenders’ collections functions are now concentrated in the middle stages of delinquency, rather than early or late stages. The initial takeaway: Consumer financial stress is being expressed through duration in delinquency. In this article, we use data and insights from Auriemma Roundtable’s Auto Collections Roundtable to shed light on how collections teams are adjusting.

Borrowers are Staying in Delinquency Longer

Auto lenders have observed troubling trends in middle- and late-stage delinquency in recent quarters: Borrowers who fall meaningfully behind – two or more billing cycles – are spending more time between roughly 60 and 120 days past due than in prior periods. (Previously, more borrowers would either become current, with a smaller proportion rolling straight through to late-stage delinquency.)

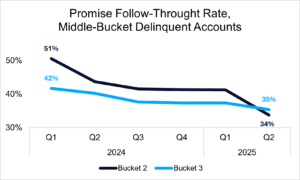

Source: Auriemma Roundtables Benchmark Data

This erosion in promise follow-through is one of the mechanics behind the longer duration emerging in late-past-due populations. As Bucket 2 and Bucket 3 borrowers make fewer promised payments — sliding from roughly the low-50s and low-40s percent ranges in early 2024 to the mid-30s by mid-2025 — fewer accounts are converting forward into cure. Those missed commitments do not immediately become charge-offs. Instead, they contribute to the extended dwell time collections teams are now carrying. Lower follow-through rates, in effect, produce a heavier middle of the delinquency curve.

Roundtable participants first observed this pattern emerging in late 2024. Lenders described borrowers “floating” in this zone month after month. Instead of being a short handoff between early-stage delinquency and eventual resolution, this range has become an active operating environment where customers remain in play for materially longer periods of time.

When borrowers remain in this segment for longer periods of time, the mix of work for collections teams shifts. Accounts that once might have returned to current are remaining open to intervention for multiple consecutive months, leading to more sustained activity in the later buckets.

As a result, when an account is in the 45- to 60-days past due range, many Auto Collections Roundtable members are adjusting treatment, queue placement, or contact strategy to reflect the possibility that the borrower may take incremental action to keep from rolling into later stage delinquency. Because the borrower can still make a payment and there is opportunity to change the trajectory, the intervention point has shifted into Buckets 3 and 4 instead of waiting for delinquency to age further.

A Parallel Pattern in Canadian Markets

The same trend is emerging in Canada. In recent Canadian Auto Operations Roundtable discussions, lenders described a similar elongation in past-due status and an uptick in voluntary repossessions, reinforcing that this is not an isolated U.S. dynamic. The operational strain is also concentrating in the middle of the delinquency curve, where the greatest volume of “workable” accounts now live.

Tariffs are a differentiator in the Canadian conversation, but they still connect back to the same underlying theme. Some Canadian lenders are mapping tariff exposure to specific industries and geographies to anticipate where disposable income stress might show up first. The concern is not that tariffs create a sudden spike in delinquency, but that they incrementally compress household capacity and lengthen how long borrowers sit behind rather than catch up. In that way, tariffs act as an accelerator of the same duration-based phenomenon the U.S. is seeing: stress expresses itself through time spent late, not just through higher balances, and collections becomes the place that absorbs the effect.

Changes in Repossession Assignment Timelines

Based on these trends, Auriemma Roundtables is observing changes in repossession assignment timelines, with some lenders assigning repossession at earlier thresholds for higher-risk borrowers because the probability of cure appears lower once an account has already entered Buckets 3 and 4. Earlier assignment is not being used as a blunt escalation, but rather in recognition of where the account is most likely to be resolved.

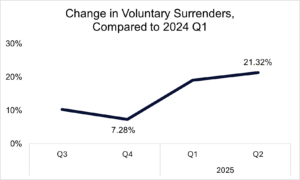

Voluntary surrenders have become more frequent in recent quarters. In many of these cases, affordability issues arise before the loan has seasoned, and borrowers choose to return the vehicle. While the car leaves the borrower’s possession, the economic exposure and resolution steps continue through collections. As a result, voluntary surrender flows into the same operational channel as other late-stage activity. It adds volume to the same ecosystem and contributes to the extended duration of activity in this stage of delinquency.

Source: Auriemma Roundtables Benchmark Data

Implications for 2026

Late-stage delinquency is lasting longer, and lenders are adjusting treatment because of it. In previous years, once a borrower reached roughly 60 to 120 days past due, lenders could usually see whether that account was on track to cure or on track to eventually charge off. Today, that clarity takes longer to emerge. Borrowers remain in that late-stage window for more cycles, and multiple paths remain viable for a longer period, such as partial catch-up or short payment arrangements.

This has practical implications for collections planning. Teams are spending more time with accounts that are neither early-stage nor fully resolved. Lenders are reviewing hardship eligibility and adjusting vendor sequencing earlier. And they are focusing collector capacity on middle buckets, because this is where the most interaction continues to occur.

One of the key focus areas for 2026 will be managing adjustments in segmentation, contact, or treatment can create meaningful differences in outcome in these middle buckets. The question will be less about whether delinquency is rising or falling in a given month and more about how the extended duration in late-stage changes the operating model.

How Auriemma’s Auto Collections Roundtables Sharpen Operational Clarity

The Auto Collections Roundtable and the Canadian Auto Operations create the environment where lenders can surface patterns like these in near real time. When executives sit together and walk through whether roll rates are thickening, whether extension requests are clustering, or whether voluntary surrenders are accelerating earlier in the term, the value is in the shared visibility. Membership tools, including meetings, data, and custom research, help members clarify whether a signal is specific to one portfolio or showing up broadly across the group, and that context shapes which operational adjustments merit attention.

If you are seeing similar dynamics inside your non-prime portfolio and want to understand how peers are calibrating treatments inside this extended middle section of delinquency, reach out to Barry Lynch (Auto Collections) or Zeenat Shah (Canadian Auto) to learn more. For additional insights on the collections and asset recovery space, check out our partners at insideARM.com.