September 14, 2020

COVID-19’s Effect on Credit Card Billing Disputes

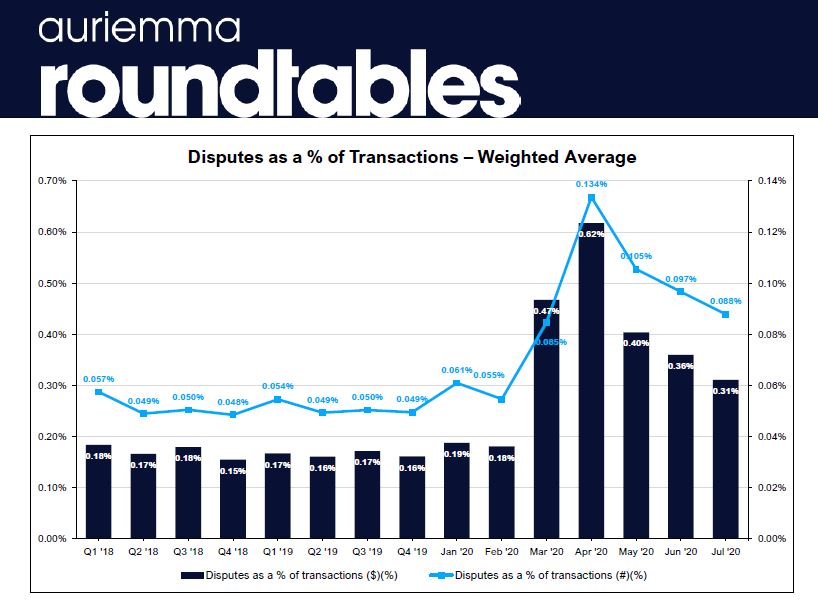

Credit card billing disputes as a percentage of total sales/transactions jumped dramatically following the outbreak of the COVID-19 pandemic in March 2020. The metric peaked in April as cardholders abandoned travel plans and other recreational/leisure activities amidst national/global lock downs – consequently driving up the T&E dispute volumes for card issuers across the industry.

The subsequent months’ data aligns with the narrative shared by members of Auriemma Roundtables’ Card Chargeback group– i.e., although disputes as a percentage of sales have subsided from the initial peak, it remains significantly higher than the steady average seen pre-pandemic and members expect it to plateau at this level for the remainder of the year. The nature of the disputes has also shifted from T&E to online merchandise disputes becoming the primary driver.

To get in touch about our Card Chargeback Roundtable, click here.