March 18, 2025

Personal Loan Performance: What Data and Regulatory Trends Reveal

Fluctuating economic conditions, regulatory shifts, and evolving consumer behaviors are reshaping the unsecured personal lending space.

To grow portfolios effectively amid the current environment, lenders must stay vigilant and adapt to these emerging trends to manage risks and capitalize on opportunities.

Economic Indicators and Vintage Performance

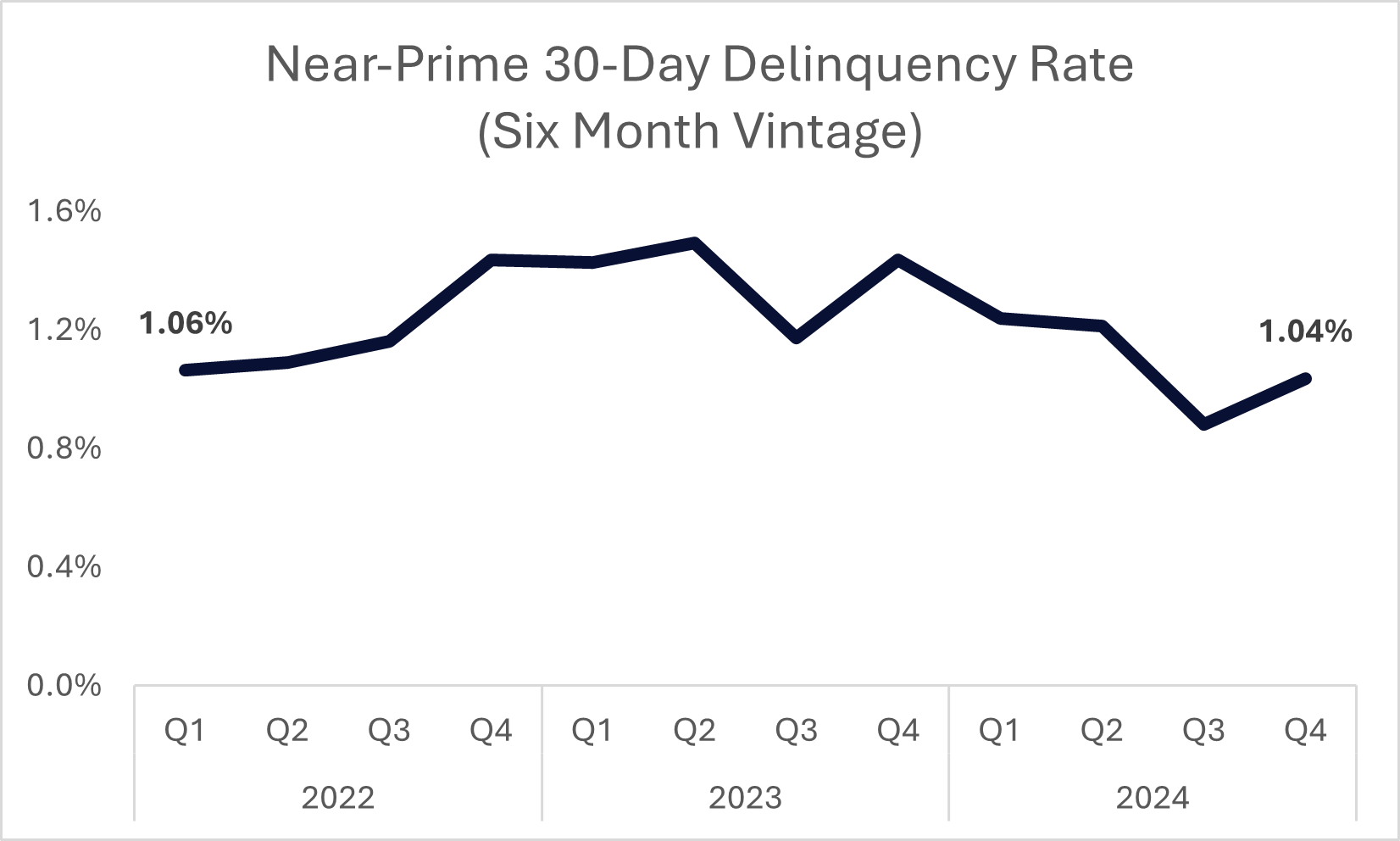

Personal loan vintages originated in early 2024 have demonstrated improved performance compared to loans originated in Q1 2023. This improved performance can likely be attributed to strategic credit tightening and an acclimation to the higher interest rate environment that debuted in 2022. Auriemma Roundtables’ benchmarking data indicates delinquency rates for near-prime borrowers have returned to 2022 levels after seeing an increase in 2023, as the market has begun to adjust to higher interest rates. Other credit tiers saw similar patterns.

However, there are two industry-wide speed bumps for 2025 growth – rising first-party fraud and an increase in borrowers with higher debt-to-income (DTI) ratios. This will likely impact 2025 profitability and risk, according to Auriemma Roundtables Director Ed Torres. Consequently, Auriemma Roundtables anticipates that lenders will continue to refine their credit policies, employing advanced analyses to detect fraud risk and implementing stringent fraud prevention measures.

Policy and Regulatory Landscape

The regulatory environment remains dynamic, with discussions around credit card interest rate caps gaining attention. During his campaign, President Trump proposed a temporary 10% cap on credit card interest rates, which could have ripple effects in the uncollateralized lending market. However, it’s unclear whether such a move has enough support to amend the Truth in Lending Act. Similarly, Senator Josh Hawley’s 2023 proposal to cap card interest rates at 18% has stalled in committee. Even if momentum stalls, lenders should monitor these developments closely since any legislative changes could significantly impact pricing strategies and profitability.

Fraud Trends and Mitigation Strategies

A rise in credit washing and first-party fraud has notably influenced delinquency trends, with first-party fraud often reported as credit losses due to synthetic identities. Lenders are proactively assessing internal strategies and leveraging third-party tools to identify fraud indicators early in the origination flow and credit cycle. Continuous back-testing of fraud detection models ensures quality control and adaptability to emerging fraud tactics.

Alternative Data Utilization

While alternative data sources are extensively used in other financial products, their application in personal loan decisioning has been comparatively limited. Instead, lenders are harnessing internal deposit-side data (if available) or liquidity tools alongside traditional bureau information to inform credit strategies. Some institutions utilize tools for income verification/estimation, although these tools often provide net deposit data, which may not accurately reflect gross income. Ensuring data accuracy and relevance is crucial to maintaining robust credit assessments.

Buy Now, Pay Later (BNPL) Considerations

The growing popularity of BNPL options presents challenges in tracking consumer debt levels, raising concerns about applicants’ debt loads, as well as potential overlaps with traditional personal loans. Lenders are conducting multivariate analyses to predict which accounts are more likely to utilize BNPL services, aiming to mitigate associated risks. There is also speculation that the BNPL sector may face increased regulatory scrutiny if consumer adoption continues to rise throughout 2025, but that is subject to the Trump administration’s cuts to oversight agencies.

Debt Settlement Companies (DSCs) Impact

A notable number of consumers have also shifted from traditional hardship programs and bankruptcy filings to debt settlement relief companies. This trend has affected collections recovery rates. The proliferation of DSC advertising has contributed to this uptick, prompting lenders to reassess collections strategies that rely on bankruptcy data. Understanding this migration is essential for accurate risk assessment and effective collection practices.

About Auriemma Roundtables’ Personal Loan Roundtables

Fortunately, lenders don’t need to navigate shifting economic conditions to emerging fraud trends and regulatory uncertainties alone. Staying informed by sharing best practices and benchmarking against peer organizations can help lending leaders stay ahead of market trends. For exclusive, data-driven insights and a collaborative cohort of professionals, reach out about our Personal & Student Lending Collections, Personal Lending Product Management, and Personal Lending Risk Management Roundtables.

Ready to get started? Contact Tami Corsi.