April 25, 2024

What to Consider When Digitizing Customer Service

Call reduction has long been the goal of efficiency-seeking contact center executives.

The proliferation and improvement of tools like the IVR, chatbots, and digital self-service platforms have delivered increased accessibility and ease of use for many consumers. However, call reduction and digital-specific CSAT improvements have remained elusive, according to Auriemma Roundtables benchmark data from several of its Customer Service studies. While FIs have widely deployed self-service options, contact centers continue to report significant call volumes that have not been offset by other channels.

So, why haven’t call volumes significantly dropped off, despite these innovations? Below, we identify some of the key drivers that keep the consumer calls coming.

The Surprising Staying Power of Phone Calls

A sizeable proportion of users remain loyal to phone interactions. According to the most recent Auto Customer Service benchmark, for example, phone agents still resolve nearly 40 percent of customer inquiries.

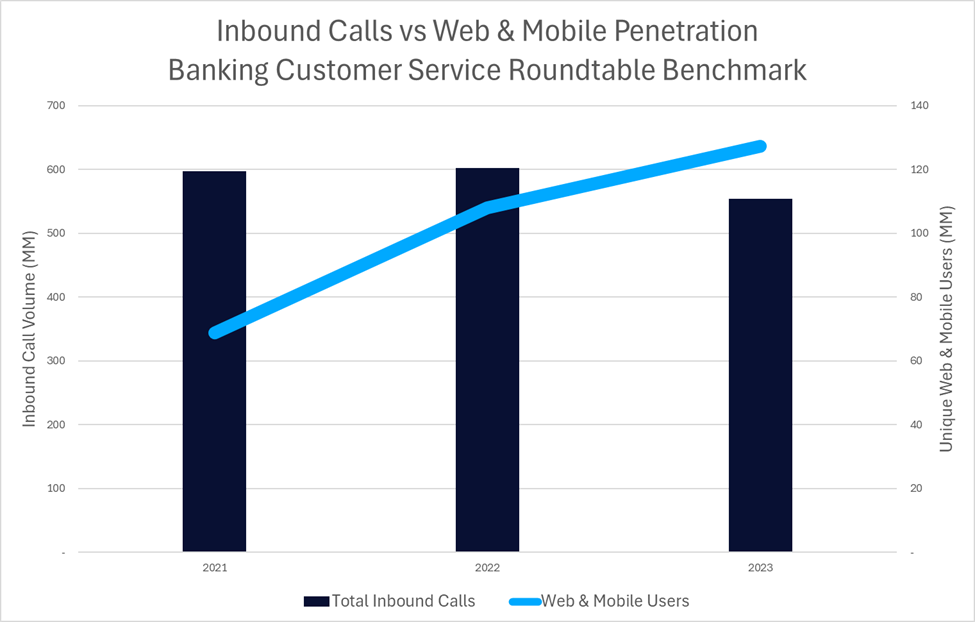

On the consumer banking side, total call volumes have ticked downward only slightly in recent years, despite a nearly 100 percent increase in web and mobile app penetration.

Source: Auriemma Roundtables’ Bank Customer Service Roundtable Benchmark Study

The causes, according to Auriemma Roundtables’ Customer Service members, include:

- Technology-related issues, such as multifactor authentication problems and password reset requests, push users who are trying to use digital avenues to contact an agent.

- Payments continue to drive call volume, despite the self-service options available. Roundtable members report that cohorts of customers consistently either call to make payments with an agent or call after making a payment digitally to ensure it was posted.

- A similar phenomenon occurs when customers are switched to paperless statements: A subset will call to inquire about information that was delivered electronically.

In short, self-service tools divert some calls and tend to reduce total call volume. However, they generate their own inquiries as well, so introducing phone alternatives does not result in a one-to-one offset.

Agents Have Better CSAT than IVR and Web Interactions

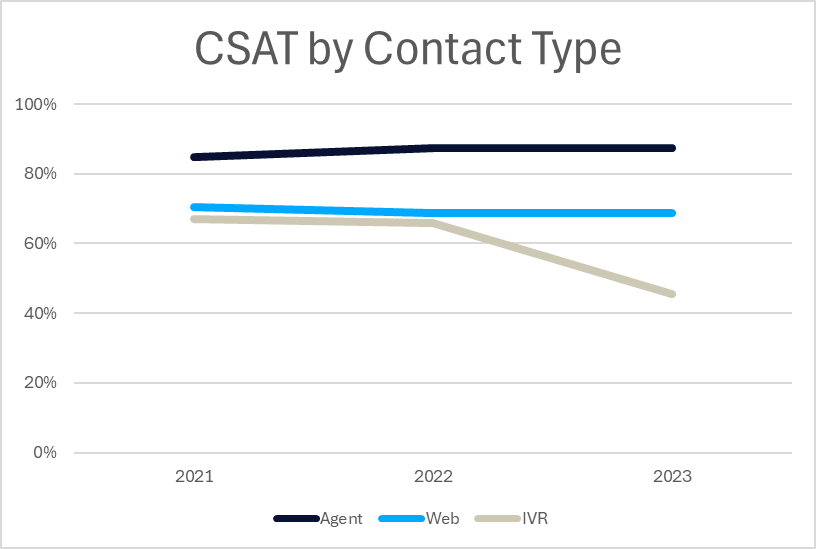

Phone agents continue to outperform their digital competition when it comes to customer satisfaction, even as IVR and web-based self-service platforms would have ostensibly improved with advancing technology. A negative self-service or digital experience has the potential to create multiple downstream impacts, including a feedback loop, in which dissatisfied users will insist on a phone agent in the future.

Source: Auriemma Roundtables’ Auto Customer Service Benchmark Study.

Using Autopay to Head Off Inquiries

While payments continue to drive volume, this trend has not been observed in autopay enrollees, according to Roundtable participants. Autopay users tend to contact call centers less often, as it removes password reset calls that generate volume.

While initial autopay enrollment can present its own challenges, contact center leadership sees it as a long-term investment in user satisfaction and operational efficiency.

Autopay represents one of the biggest efficient opportunities for FIs: Across the Card Customer Service, Wealth Management Customer Service, Bank Customer Service, and Auto Servicing benchmark studies, only about 30% of accounts are currently set up for autopayments.

About Auriemma Roundtables

Auriemma Roundtables give leading financial services companies access to the right people and data to help them optimize their business practices, maximize efficiency, and navigate complexity. The result for members? Solutions that work for them, measurable ROI, and a roadmap for the future.