February 10, 2025

When Prime Customers Are Actually Fraudsters: What Auto Default Rates Say About Fraud Trends

A growing trend of prime-rated borrowers defaulting on auto loans has raised red flags among lenders, according to Auriemma Roundtable Directors Troy Huth and Jaime Paz.

The culprit? A surge in synthetic identity fraud and credit washing schemes that allow bad actors to appear more creditworthy than they truly are.

The Rising Concern Among Lenders

Despite having strong credit scores, a growing number of prime borrowers are exhibiting delinquency trends more typical of subprime borrowers – raising concerns about increased credit washing and synthetic identity fraud. Although the mechanics differ, both practices result in credit lines that would otherwise not be created. As synthetic fraud continues to surge and credit washing tactics become more sophisticated, lenders must adopt advanced identification verification measures to accurately assess borrower risk and protect the integrity of the auto lending market.

The Hidden Threat of Synthetic Identity Fraud in Auto Lending

Synthetic identity fraud has become the fastest-growing form of fraud, surpassing traditional credit card fraud and identity theft and estimated to cost businesses between $20 to $40 billion annually. Criminals use stolen Social Security numbers and fictitious identities to establish fraudulent credit profiles to secure auto loans they never intend to repay.

This deception is now affecting delinquency rates, with more supposedly prime borrowers defaulting at unexpected rates – suggesting that synthetic fraud is passing origination controls and lurking within auto portfolios. As lenders scramble to combat this issue, they are turning to advanced fraud prevention tools and AI-driven solutions to detect and mitigate the impact of synthetic identities on the auto lending market.

“It’s difficult to know exactly how much of the rise in delinquency among ostensibly prime borrowers is due to fraud, but there is a growing sense it’s playing a more prominent role than we’ve seen in the past,” said Troy Huth, Director of Auriemma Roundtables’ Bank Fraud Control group. “Some of these ‘prime’ borrowers were never really prime to begin with.”

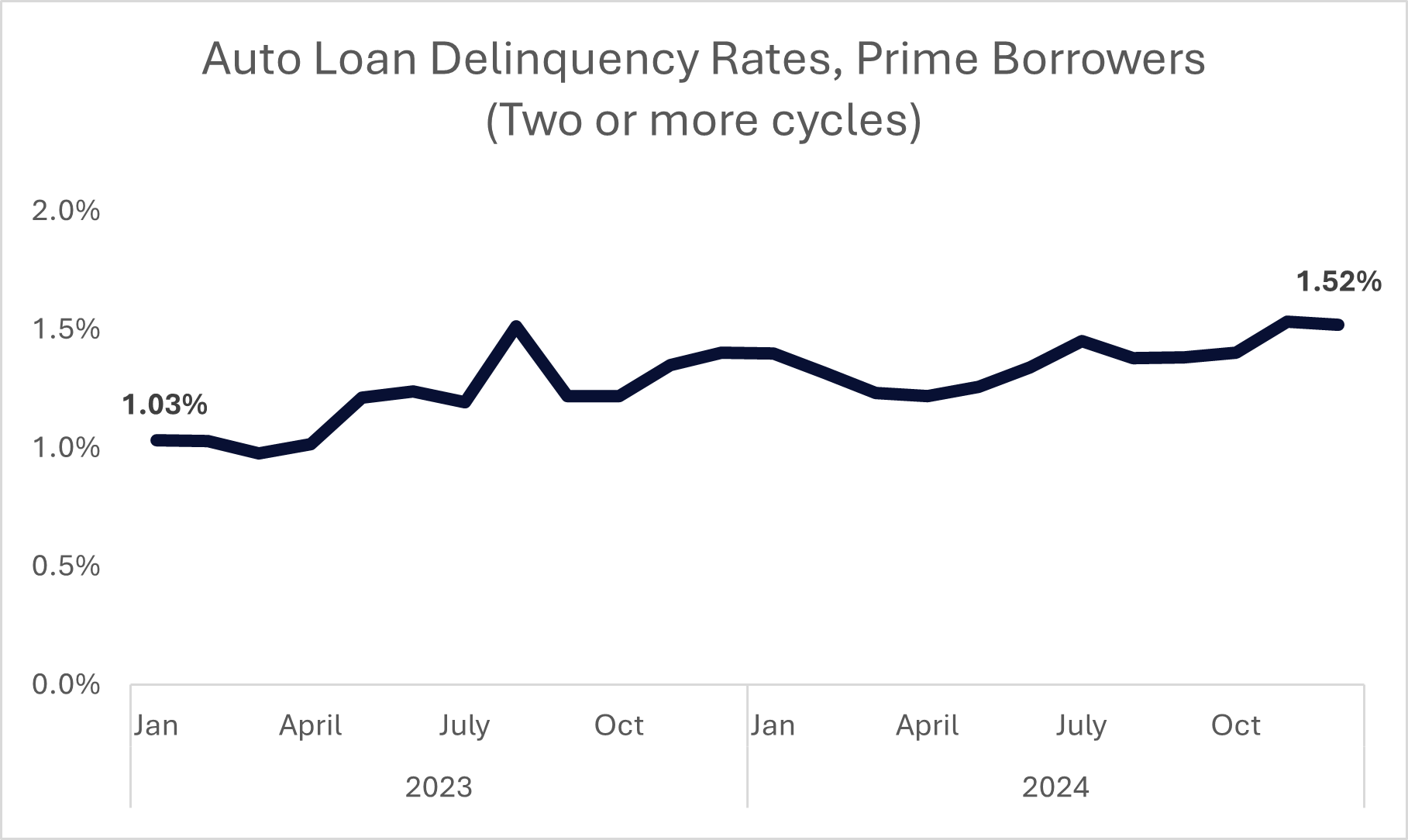

Meanwhile, the rise in delinquency rates among prime borrowers has been profound. In 2023 and 2024, the proportion of such accounts that were two or more months into delinquency rose by 50 percent, according to Auriemma Roundtables data.

Credit Washing, an Adjacent Trend

Credit washing is an emerging challenge in auto lending, where fraudulent credit repair firms dispute legitimate negative tradelines by falsely claiming identity theft, resulting in artificially inflated credit scores.

Many consumers engaging with these firms are unaware of the fraudulent nature of the process, believing they are using legitimate credit repair services. As a result, lenders may not be able to rely on credit reports alone, as manipulated profiles increase their exposure to defaults and losses.

Regulatory changes have made credit washing easier to perpetrate, as borrowers are no longer required to file police reports or affidavits to dispute fraudulent credit lines. This allows bad actors to scale their operations, further complicating lenders’ ability to assess true creditworthiness. Without stronger safeguards, credit washing will continue to distort risk evaluations and contribute to rising delinquencies in auto lending.

“Credit washing has made it increasingly difficult for lenders to accurately assess borrower risk,” said Jaime Paz, Director of Auriemma Roundtables’ Auto Fraud Control group. “Fraudulent credit repair schemes manipulate credit reports, allowing high-risk individuals to qualify for loans they should never receive. Without stronger safeguards and improved fraud detection mechanisms, this trend will continue to distort risk evaluations and drive up delinquency rates.”

Data Trends Indicate Fraud is Shifting

Some Auto Fraud Roundtable member lenders report while title washing and subleasing are relatively rare compared to other fraud categories, the other types of fraud are increasing in prominence:

- Identity theft

- Synthetic fraud

- False identity theft claims

- Social media exploitation: Platforms where individuals can “buy” co-applicants without their knowledge, leading to fraudulent loan approvals

Auto lenders often also indicate such fraud types can take multiple billing cycles or even enter into delinquency before the fraud is detected, making it even more pernicious.

The Road Ahead

As fraud tactics become more sophisticated, lenders must remain vigilant and adapt their fraud detection strategies. Enhanced verification processes, AI-driven fraud detection, and deeper scrutiny of prime borrowers’ applications are becoming necessary to curb fraud. Without aggressive intervention, the growing presence of fraudulent borrowers could distort risk assessments.

Peer-sharing approaches strengthen lenders’ ability to safeguard against financial and reputational risks, fostering trust and confidence among customers while ensuring long-term stability and success. Auriemma Roundtables’ member groups can help fraud prevention leaders identify trends and tack common challenges in combatting bad actors.

For more insights on how data can enhance fraud detection strategies, visit the Auto Fraud Roundtable page or reach out to Zeenat Shah.