December 9, 2020

Credit Card Disputes Have Not Decreased to Pre-Pandemic Levels

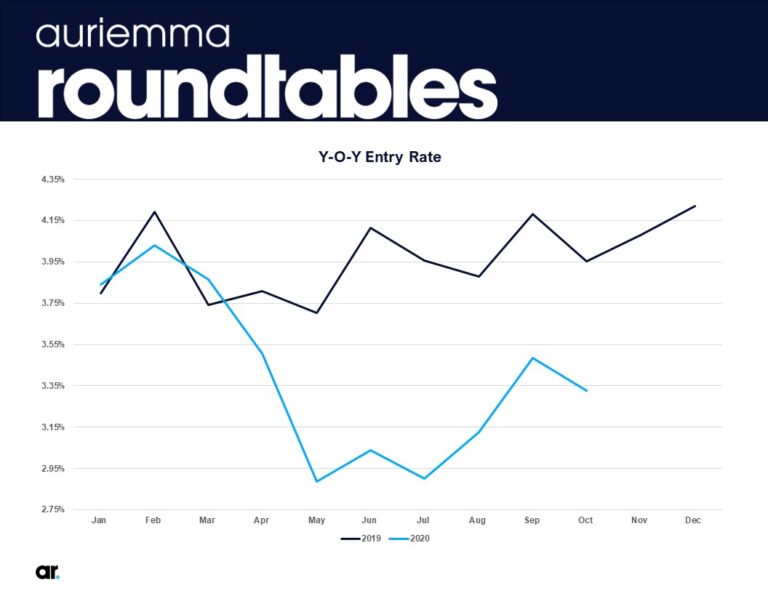

COVID-19 sent credit card billing disputes to historic heights in March/April 2020, as consumers grappled with travel restrictions and the shutdowns that followed. Disputes were concentrated in the T&E sector at the onset of the pandemic, with customers disputing purchases for vacations, cruises, and concerts, resulting in a 2-2.5x spike in billing dispute dollar volumes across the industry when compared to pre-COVID levels.

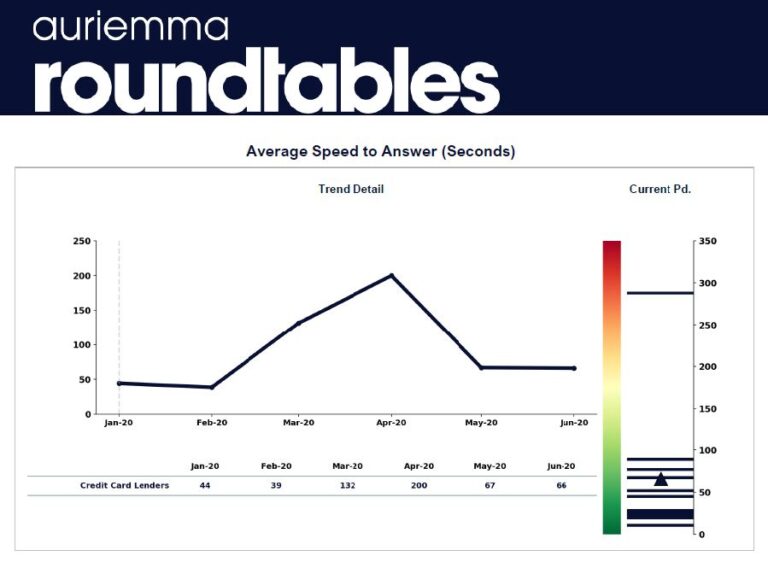

While the initial tsunami of disputes has abated from the springtime peak, dispute volume still hasn’t returned to pre-pandemic levels, creating a challenge for credit card issuers still working through the realities of an extended work-from-home environment. The sustained increase in volume will have implications for productivity and staffing, particularly with holiday spending signaling another potential spike in the near future.

“In March, banks were scrambling to put together a work from home strategy,” said Ira Goldman, Senior Director of Auriemma Roundtables and leader of the Card Chargeback Roundtable. “As a result, productivity was impacted as employees were getting acclimated.”

FIs worked fast to turn the tide. To take the pressure off, write-off thresholds were increased, temporarily pushing the number of write offs (as a % of disputes) to 20%, according to Auriemma Roundtables data. This temporary change translates to less work for the representative to resolve the dispute – in this case, in the customer’s favor.

Since the initial virus-related spike, volume has decreased, and productivity has improved. Dispute volume has also shifted from T&E to online goods/merchandise, as consumers increasingly shop online and avoid public shopping areas. Common reasons for CNP disputes include merchandise not being received, cancellations, and quality issues.

FIs expect another spike in disputes after the holiday shopping season. Not only does Q4 historically exhibit increased online spend, that trend will likely be augmented this year due to COVID related shopping patterns, resulting from extended Black Friday sales. To prepare, FIs are budgeting to be better staffed and avoid burnout among their Disputes teams. Some practices being considered or implemented include:

- Bringing in back-up resources from other departments to assist

- Hiring new staff: While this is difficult in a virtual environment, the case was made to bring on additional workers for more than just a seasonal hiring period

- Leveraging overtime as necessary

- Equipping frontline agents with adequate training and transaction information to deflect cases that need not be disputed

In addition to staffing and training practices, organizations are also looking into policy changes and vendors that can offset volume-related stress on operations. These best practices include:

- Fine-tuning processes to monitor for first-party fraud, malicious intent or buyer’s remorse to stem frivolous dispute volume

- Proactive consumer-facing communications, such as IVR recordings, reminding customers to dispute with merchants first

- Enabling self-service dispute journeys

- Use of third-party vendors (Ethoca and Verifi are examples) to reduce dispute handling

This level of credit and debit card disputes represents an opportunity for issuers to invest in and improve their operations. Focus areas should include introducing automation to the dispute resolution process, adding more channels to address disputes, and identifying new efficiencies in existing processes.

About Auriemma Roundtables

Auriemma Roundtables give leading companies access to the right people and data to help them optimize their business practices, maximize efficiency, and navigate complexity. The result for members? Solutions that work for them, measurable ROI, and a roadmap for the future.

For more information on Auriemma Roundtables’ Card Chargeback group, contact Ira Goldman.