October 28, 2020

How FIs Are Addressing Rising Customer Anger – and Protecting Employees

Dealing with angry and frustrated customers comes with the territory for customer service agents. But as the coronavirus has pummeled many customers’ jobs and financial security, it’s boiled over into more abusive calls aimed at financial institutions’ customer service agents.

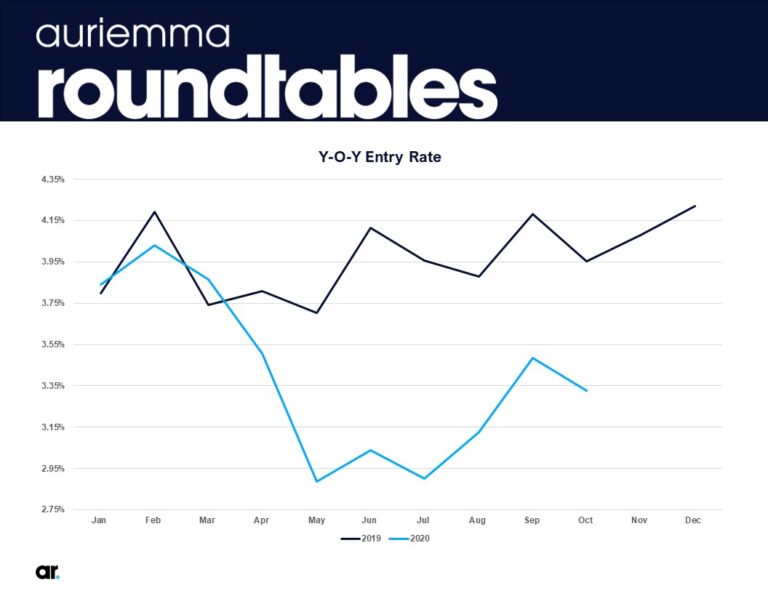

According to research from Auriemma Roundtables’ Customer Experience and Complaints Roundtable, more than half (54.55%) of responding FIs reported an increase in abusive calls YTD when compared to the same period in 2019. The effects of abusive calls can be serious for agents, ranging from stress and burnout to decreased attendance and productivity.

Within the last year, 81.82% of survey respondents reported their organizations had recently augmented abusive caller policies and/or protections for agents. For one, companies have sharply defined the difference between a dissatisfied customer and an abusive one. Policies and processes are often explicit in triggers words and phrases that cross the line into abusive, including the use of profanity and discriminatory language towards a worker’s race, national origin, age, gender, or sexual orientation.

“A typical angry or upset customer can usually be defused,” said Kathy Castle, Senior Director at Auriemma Roundtables. “Every agent is trained to de-escalate situations. But more protections are being put into place for instances in which anger crosses over into hostility and threats.”

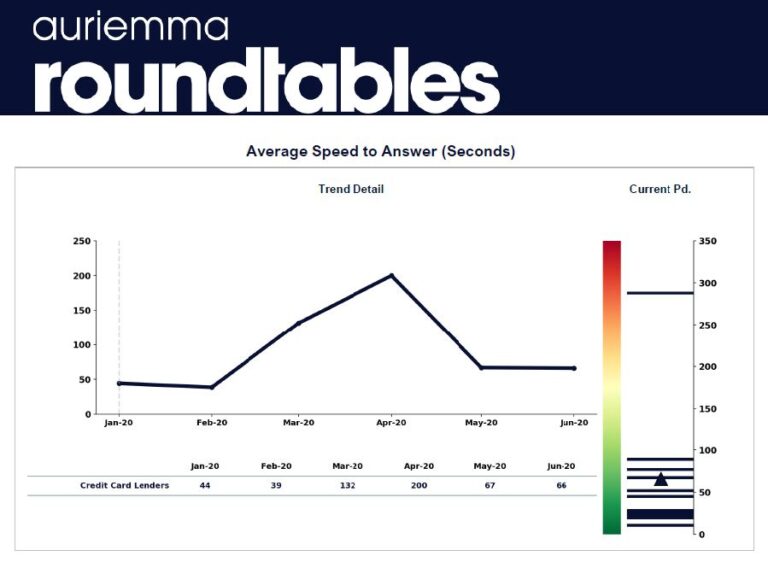

Credit card companies are aware of the pandemic-related stresses affecting customers, and companies quickly adopted a tailored, compassionate tone during the pandemic and ensuing economic slowdown. This tone was crucial when contact centers saw a spike in calls to enroll in special pandemic relief programs, according to Castle, who leads Auriemma’s Card Customer Service Roundtable.

But when calls still turn abusive, there are multiple best practices to support employees including:

- Leveraging data analytics to monitor for key words and phrases. This is crucial as employees may under-report these incidents.

- Providing agents with options to get off the phone when a call turns abusive. This includes scripting disconnect language or prescribing escalation pathways to specialized units or managers.

- Developing policies/procedures that define any additional steps to handle abusive customers, from warning letters to closing accounts.

With many customer service agents in similar situations to the calling clients (working from home and possibly dealing with sick family members), it is more important than ever that FIs support agents.

“There’s been an increasing focus on employee wellness, engagement, and retention even before the pandemic — but, especially since,” Castle said. “The key is for customers to know that agents want to help. They respect you. Respect them.”

About Auriemma Roundtables

Auriemma Roundtables give leading companies access to the right people and data to help them optimize their business practices, maximize efficiency and navigate complexity. The result for members? Solutions that work for them, measurable ROI and a roadmap for the future.

For more information on Auriemma Roundtables’ Customer Service Roundtables, contact Kathy Castle.