December 1, 2025

Credit Card Preview: Speed and Scrutiny in 2026

The credit card ecosystem is entering 2026 with mixed consumer sentiment stemming from increasingly personalized fraud attacks, a rapid shift toward trusted digital and in-app servicing channels, and mounting expectations for faster, more reliable authentication across every touchpoint.

And credit card issuers are enacting new policies and safeguards to meet the challenges of the environment. In originations, executives are tightening verification requirements, recalibrating approval criteria, and expanding dynamic income and cash-flow checks. Fraud teams are deploying deeper authentication layers, accelerating real-time anomaly detection, and coordinating more closely with carrier and data partners to counter increasingly personalized attacks. Contact center leaders are rapidly reinventing the contact center as fraud intensifies, customers shift to trusted digital channels, and AI becomes essential to authentication, coaching, and service delivery. Collections teams are learning to operate in a world where “right-party contact” is more uncertain than ever. Recovery efforts face a post-charge-off environment shaped by higher costs of funds, more litigation, and customers who increasingly arrive through a Debt Settlement Company.

Auriemma Roundtables is tracking these challenges across the credit card lifecycle using data and insights from our member institutions. From origination to charge-off, there is a clear throughline: 2026 is shaping up to be the year where institutions must operate with more precision, more segmentation, and more adaptability than ever before.

The Risk Landscape: Instability Rising to the Surface

Heading into 2026, consumer risk signals point to a more fragile credit environment, with liquidity strain emerging despite stable headline performance. Revolving balances are rising and missed-minimum rates remain elevated year-over-year, while credit washing continues to distort credit files in ways that obscure true borrower health. As a result, issuers are leaning more heavily on dynamic, harder-to-manipulate indicators and preparing for a year defined by greater selectivity rather than broad expansion.

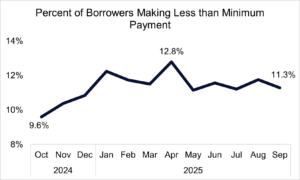

While the proportion of borrowers not making minimum payments is down slightly from its April peak, it remains elevated year-over-year, up 16% between October 2024 and September 2025.

Source: Auriemma Roundtable Benchmark Data

Source: Auriemma Roundtable Benchmark Data

What complicates matters further is the continuing rise of credit washing. Suppressed tradelines and mass disputes are distorting credit files, making consumers appear healthier than they are. Several issuers noted that credit washing is no longer confined to distressed borrowers; it has crept into higher-score tiers, which reshapes how lenders interpret FICO distributions and behavior-score trends.

For 2026, that means underwriting organizations will need to rely more heavily on dynamic indicators: income stability, cash-flow trends, deposit volatility, digital engagement, and other signals that are harder for manipulation to mask. Many are preparing credit-policy “flex zones” that allow for rapid adjustments – quick shifts to approval criteria, verification requirements, and segmentation rules – as they collect more data on who is performing and why.

“Stress testing isn’t new, but the inputs are changing,” said Troy Huth, director of Auriemma’s Credit Risk Management Roundtable. “In 2026, issuers will look more to cash-flow resilience, deposit behavior, and income trends to understand how quickly a seemingly strong borrower could weaken if conditions shift.”

The result will be a 2026 risk environment defined more by deliberate selectivity than broad expansion.

Card Fraud in 2026: A More Coordinated, Customer-Focused Threat

Card Fraud Control Roundtable members describe 2025 as a turning point due to the maturation of fraudster tactics. Fraudsters are not simply exploiting controls; they are exploiting human behavior. They are attacking provisioning flows, social-engineering customers, intercepting OTPs, leveraging spoofed caller IDs, and coordinating wallet-based attacks across multiple channels. What does this mean in 2026? More layered authentication, more real-time detection, and more coordinated defenses that close gaps between digital, call-center, and wallet ecosystems.

Account Takeover and Provisioning Attacks

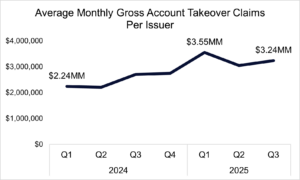

Account takeover remains extremely disruptive in the card space and is up 36% from Q1 2024—showing how bad actors continue to adapt, despite the increasing sophistication of defenses like spoof-detection vendors, network intelligence, and carrier-level partnerships.

Source: Auriemma Roundtable Benchmark Data

Source: Auriemma Roundtable Benchmark Data

In wallet provisioning, for example, fraudsters manipulate device settings, quickly adding the same card to multiple digital wallets, or pushing through a rapid series of tokenization attempts, all of which create patterns that are hard to distinguish from legitimate customer behavior. These signals often show up only minutes before an attack begins, giving issuers very little time to intervene. With more authentication and verification steps shifting into mobile apps, rather than occurring through traditional online or call-center channels, fraud teams expect wallet-provisioning schemes to remain a major challenge in 2026.

What’s clear is that OTP-based authentication faces challenges with interception, man-in-the-middle attacks, SIM swaps, and customers who inadvertently validate fraud in real time. Institutions are responding by moving toward device binding, push-based step-up methods, and biometric authentication as their primary guardrails.

Scam Trends

The most striking trend heading into 2026 is the rise of scams, especially bank-impersonation scams. Fraudsters now pair AI-generated voices, spoofed inbound numbers, and highly rehearsed scripts to make the contact feel legitimate. In several cases, they even physically visit consumers’ homes to “collect compromised cards.”

“Scams have become the most human-engineered threat we face,” said Jaime Paz, director of Auriemma’s Card Fraud Roundtable. “Fraudsters are blending AI voices, spoofed numbers, and scripted coaching to create interactions that feel completely legitimate, and it’s pushing issuers to rethink customer education and migrate alerts into channels consumers can actually trust.”

The shift is forcing institutions to rethink customer education entirely. In-app messaging is replacing wide-scale SMS campaigns, and lenders are distributing more targeted alerts tied to specific scam patterns. Some are evaluating whether to consolidate customer alerts into verified, secure digital channels to eliminate ambiguity.

This is not a short-term challenge. Fraud teams expect scam losses to remain elevated well into 2026 and beyond, prompting more cross-industry information sharing and more sophisticated device-intelligence monitoring.

Customer Service: Inroads for Digital Servicing and AI

Heading into 2026, card issuers say the contact center is undergoing its most dramatic shift in years as rising fraud, new digital habits, and elevated customer expectations converge. Customer expectations continue to expand, and the contact center remains the place where rising consumer stress, rising fraud, and rising digital complexity all collide, Card Customer Service Roundtable members report.

Voice authentication, a longtime staple of contact centers, is being rebuilt from the ground up. Deepfake audio, spoofed numbers, and account takeover events flowing through the call center have pushed issuers to adopt more advanced verification: voice biometrics, ANI validation, carrier partnerships, and data-layer authentication that happens before an agent even says hello.

These models remove emotional pressure from agents who often serve as the last line of defense during social engineering attempts.

Meanwhile, growth in asynchronous channels is not slowing down. Customers increasingly prefer texting for simple requests, high-friction account actions, and even payment arrangements. It’s familiar, fast, and feels low-effort—especially when paired with proactive nudges or payment reminders.

In-app messaging is fast becoming a channel of choice for card issuers and customers alike: It’s a channel that customers trust, that cannot be easily spoofed, and that keeps communication tied directly to the account environment. In 2026, many issuers expect digital servicing to shift from “channel of convenience” to “channel of record,” especially as fraud concerns push institutions to clarify which messages customers should trust.

“We’re watching the contact center transform faster than any other part of the servicing ecosystem,” said Steve Sion, director of Auriemma’s Card Customer Service Roundtable. “Fraud sophistication, digital behavior, and customer expectations are all rising at the same time, and issuers can’t rely on yesterday’s playbook to keep customers protected or satisfied.”

AI will also play a bigger role in the contact center in 2026. Currently, AI is used to summarize calls, analyze sentiment, identify compliance risks, and guide conversation flow. Supervisors use AI-enabled quality monitoring to pinpoint coaching opportunities. Some institutions are deploying AI-driven call simulations that offer a near-realistic training environment. By 2026, issuers expect AI to become an integral layer of both security and service, shaping how customers are verified, coached, and supported across every channel.

Collections: Precise, Personalized, and Digital-First

Card Collections Roundtable members report that 2025 has been a year of improving performance and expanding digital capabilities. Delinquency is not rising sharply, but consumers are staying in delinquency longer, and payment behavior is more erratic—especially among borrowers facing broader financial strain.

Digital outreach is now the dominant strategy in early-stage collections. Email and SMS continue to show strong engagement rates, and mobile-app push notifications are quickly becoming the most actionable form of contact. This shift matters because consumers increasingly avoid unknown numbers. Many issuers expect digital identity-verified communications to serve as the foundation of their contact strategy.

Collections teams are experimenting with AI in controlled environments, particularly for quality monitoring, outbound call simulation, script generation, and segmentation optimization. Accent smoothing for offshore teams is showing early promise, and AI-assisted messaging is being tested as a way to personalize digital outreach at scale.

In 2026, it’s anticipated that AI will help collections teams manage larger volumes of inbound inquiries, predict high-risk accounts earlier, and deliver more tailored repayment options.

Meanwhile, institutions are refining hardship programs to reflect longer periods of financial stress. Short-term plans remain common, but more lenders are adding or enhancing 60-month long-term workout options. Several issuers also allow customers to self-enroll digitally, and many have moved to notification-based re-age models that give customers a clearer sense of program milestones.

For Card Recovery, A More Complex and Diversified End Game

Post-charge-off strategies are becoming more varied and more data-driven, with institutions re-evaluating the mix of internal recovery, agency placements, litigation, debt sales, and DSC engagement.

Key trends include:

- Self-service portals are becoming more common in recovery, offering settlement options, payment plans, and communication tools that reduce operational load and improve customer clarity. Some institutions are incorporating push notifications and chat-based support to drive engagement.

- More issuers are implementing structured pre-litigation outreach. Notices around the 90 to 150-day mark help prompt action from customers before placement, and pre-legal segmentation allows institutions to target accounts most likely to respond to early intervention.

- Card issuers are shifting their strategy to litigate earlier, leading to more legal placements. Litigation is expensive, but for many issuers, it’s beginning to deliver sufficiently strong results to justify expansion, especially in segments where traditional recovery channels show diminishing returns.

- DSCs remain a major factor in both collections and recovery. Institutions expect DSC engagement to increase in 2026 because consumers are increasingly turning to DSCs earlier and in larger numbers.

“Recovery teams are getting smarter about where they invest their time,” Auriemma Roundtables Director Craig Grimes said. “Data shows that early segmentation and structured pre-litigation outreach drive noticeably higher engagement, especially before an account reaches the 120-day mark, and institutions are using those signals to refine their 2026 strategies.”

The industry is responding by strengthening relationships with top settlement firms, defining clear settlement parameters, and adopting aggregation tools that improve data quality. Still, the challenge remains: DSCs tend to attract customers with the widest range of financial stress, and institutions must determine how to balance settlement efficiency with risk management.

Meet With Your Card Issuer Peers in 2026

In 2026, issuers will need sharper segmentation in underwriting, stronger authentication in fraud, clearer digital pathways in servicing, more adaptive outreach in collections, and more diversified strategies in recovery. The pace of change is accelerating, and institutions are preparing by grounding their decisions in real-time insight rather than static assumptions.

Auriemma Roundtables brings peers together to compare trends, pressure-test strategies, and respond to emerging risks before they take root. Whether your focus is risk, fraud, collections, or recovery, the ability to benchmark against fellow issuers has never been more valuable.

For more information on our Card Recovery, Credit Risk Management, or Card Fraud Roundtables, contact Zeenat Shah.

For more information on our Card Customer Service or Card Collections Roundtables, contact Barry Lynch.